Helping your clients live their

best lives. Without compromise.

How does someone plan to live their best life?

This series of case studies looks into the lives of four people and couples* who turned to Manulife Bank lending solutions to leverage their assets in order to realize their dreams.

1

Wealth decumulation into retirement

2

Wealth preservation with an eye to the future

3

How high-net-worth clients can leverage insurance to enhance cash flow

4

Lending solutions in annual financial planning

* Sample cases for illustration purposes only

Wealth preservation with an eye to the future

Helping clients increase their cash flow without depleting their assets

Through Manulife Bank lending solutions and strategies, you can help your clients use the assets they’ve accumulated to fund their best lives — in this case, a young couple looking to improve cash flow while they grow their family.

Meet Brandon & Tina ![]()

|

BRANDON 37 Computer engineer at tech start-up |

|

TINA 35 Actuary at financial services firm |

|

COMBINED $300,000 per annum + bonuses Married five years |

Brandon and Tina* are successful former downtowners who lived in a pricey condo for their first three years together before buying a new home two years ago in the leafy university area where they first met.

They’re both earning good salaries. But with their first baby on the way and much-wanted parental leaves affecting their incomes, they’re looking for ways to help keep their incomes strong and cash flow steady — and potentially generating further income to build wealth going forward.

* Sample cases for illustration purposes only

Brandon & Tina’s reality

Brandon and Tina's home is in a desired neighbourhood, giving it a better chance of increasing its value over time. But like many Canadians, they too are concerned about current market uncertainty and the rising costs of home ownership – which makes potential rental income an attractive option.

25%

feel they have overpaid for their home

20%

believe they can no longer afford the house they own

80%

think there is an affordability crisis in Canada

84%

expect interest rates and inflation to continue to increase over the next 12 months

Brandon & Tina’s assets

Since they got married, Brandon and Tina have invested aggressively and continually — maxing out their TFSAs and RRSPs, while also building a sizable non-registered portfolio.

Investments

Value

$200,000

Sizable non-registered investments

Home equity

Value

$75,000

Home valued at $900,000 but little equity

Life insurance

Cash Value

$0

$75,000 term life policy has no cash value

For illustration purposes only.

Brandon & Tina’s strategy

Non-registered investments |

Investment line of credit (ALOC)

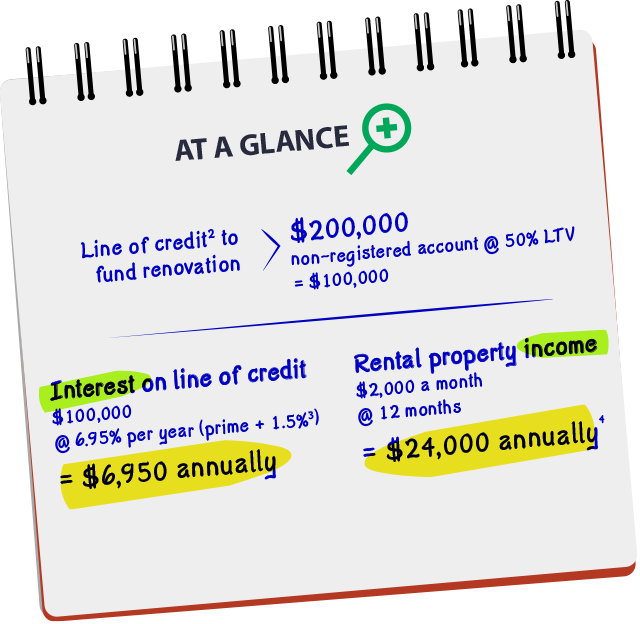

A line of credit2 obtained by using their $200,000 portfolio in non-registered investments as security helps them access up to 50% loan-to-value (LTV), without the tax implications of other strategies.

Benefit #1

Brandon and Tina have available access to $100,000 in capital, more than enough to meet the anticipated $80,000 cost of their renovations.

By leveraging their investments to secure a line of credit, they avoid tax implications that could erode that capital.**

Benefit #2

Their non-registered investments are performing well. By not liquidating them, Brandon and Tina can keep these investments intact so they can continue to grow.

The research they’ve done indicates a strong rental income potential that will go a long way to supporting the cost of financing and income tax considerations.**

Over time, Brandon and Tina will see their home appreciate in value and bring in ongoing income from their in-demand rental unit. A win-win.

2 Line of credit is subject to credit approval.

3 Interest rate is for illustration purposes only.

4 Certain tax considerations exist with respect to developing and maintaining a rental property as well as reporting the income it generates. Consult with your Manulife Bank advisor and other financial professionals for comprehensive advice.

Brandon & Tina’s best life is ahead

It’s two years into the future. Baby Gia* is walking on her own,

and Brandon and Tina’s tenant, Preeti*, is living comfortably downstairs while she majors in veterinary science. She even babysits on occasion.

Post-parental leave, Brandon and Tina are both back to their careers and picturing a future where Gia has grown up and — maybe — attending the same university they did.

Manulife Bank has the solutions and strategies in place to help Canadians live their best lives, whatever they might be.

Insurance Lending

Investment Lending

Commercial Lending