PAID CONTENT

Key Insights

- In this article, we take a more nuanced view of the active versus passive debate,

considering each approach in the context of different market cycles. - Understanding these dynamics is particularly relevant today given that financial

markets may be at an inflection point. Such an environment augurs well for

active managers. - Capital allocation is increasingly being driven by company fundamentals, rather

than by macro factors, which have historically provided heightened opportunities

for quality stock pickers.

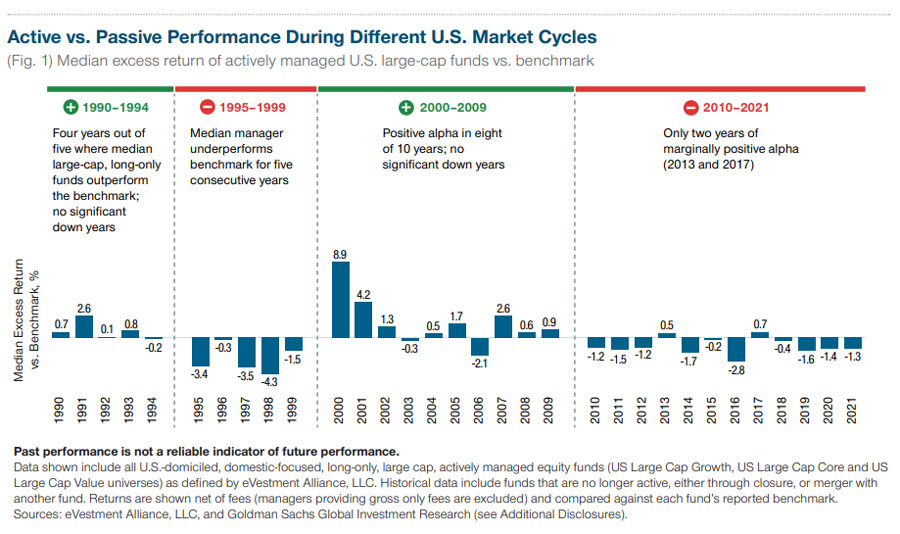

The active versus passive debate has raged for decades, with proponents on each side equally convinced that their approach is superior. Certainly, as highlighted in Figure 1, over the past 10 years, active U.S. large‑cap strategies have generally struggled to keep pace with the returns generated by passive benchmarks. Yet, for most of the preceding decade, active strategies consistently outperformed their passive counterparts, so which is better?

Unsurprisingly, there are data studies to support both active and passive management as the superior approach. And while questions about like‑for‑like comparisons cloud the analysis, often the answer depends on the period being covered. With this in mind, it is worth looking beyond the headline question of which approach is better and focusing instead on the more practical question of which has performed best during different market cycles?

“ … history can provide some guidance in the form of clearly observable performance trends during previous economic cycles and in varying market conditions.

A Potential Market Inflection Point?

Understanding these dynamics is particularly relevant today given that financial markets may be at an inflection point. After a decade‑long “Goldilocks” period of slow but steady growth, low inflation, low interest rates, and low market volatility—an environment generally supportive of a wider balance of sectors—we now face a new and uncertain stage, something already being reflected in the higher market volatility and more differentiated sector returns seen over the past year. This is where history can provide some guidance in the form of clearly observable performance trends during previous economic cycles and in varying market conditions.

Figure 1 shows that, during the 30+ years spanning 1990 through 2021, there have been four clear and distinct U.S. market cycles.1 It further reveals that passive strategies have generally outperformed their active counterparts during two of these market cycles: between 1995 and 1999 and, most recently, between 2010 and 2021. Significantly, both of these periods were characterized by economic expansion and strong bull markets, with U.S. stocks rising broadly on the back of upbeat sentiment/macro factors. This, in turn, saw stock correlations rise and the dispersion of returns between individual companies fall to low levels. This kind of “rising tide lifts all boats” scenario offers active managers fewer opportunities to differentiate between individual winners and losers and therefore add value.

Meanwhile, active strategies also outperformed during two of the market cycles: between 1990 and 1994 and from 2000 to 2009. Notably, both periods are associated with economic recession in the U.S., resulting in a more uncertain and volatile market environment. Amid the weaker macro environment, investors reverted to focusing more closely on company specifics, leading to a widening dispersion between stock returns as the good was sorted from the bad. Accordingly, more differentiated performance between companies, based on fundamental strengths, can provide more opportunities for active managers to selectively add value.

“ …U.S. stock correlations have continued to fall since early 2021, increasing the breadth of idiosyncratic investment opportunities.

Company Specifics Driving Capital Allocation

This historical analysis is important as we believe that we have once again entered a more uncertain and volatile period. The latest data suggest that the U.S. economy is in technical recession (following two consecutive quarters of declining gross domestic product), inflation is at 40‑year highs, interest rates are rising sharply, and market volatility has notably increased. While it is impossible to know how long this stage will last, this represents an ideal stock‑picking environment for quality active managers—as has been the case in the past. Indeed, for the first time since the immediate aftermath of the global financial crisis in 2009, it appears that capital allocation in the U.S. is being driven predominantly by company‑specific fundamentals rather than by the macroeconomic factors that have prevailed over much of the past decade.

Recent analysis appears to confirm this, as U.S. stock correlations have continued to fall since early 2021, increasing the breadth of idiosyncratic investment opportunities. These market dynamics underscore the importance of finding companies with competitive advantages and defined moats and the ability to pass higher prices on to end consumers. Only an active approach allows this selectivity within the current uncertain market backdrop, heightening the potential for active strategies to generate excess returns over passive strategies.

Favorable Dynamics for Active Management

We believe that the challenging market environment currently marks an inflection point as financial markets transition to a new paradigm. However, this is an environment that augurs well for active managers. High inflation, rising interest rates, stimulus withdrawal, weaker growth—for many, this backdrop is new and unfamiliar territory. Understandably, this is creating uncertainty, which is being directly reflected in increased market volatility. However, while there are numerous headwinds to negotiate ahead, we believe that the current market will continue to present favorable dynamics for active management. This kind of landscape has historically provided rich opportunities for skilled active investors as company‑specific factors should reassert themselves—and getting investment decisions right matters more.

Josh Nelson

T. Rowe Price Head of U.S. Equity

1 Cycle defined as exhibiting four stages; accumulation, mark-up, distribution, mark down. New cycle commences with the accumulation phase, immediately after the market has reached the bottom, and finishes at the end of the mark down phase, when asset prices are in decline.

Additional Disclosures

© 2021 Goldman Sachs. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of The Goldman Sachs Group, Inc.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

Canada—Issued in Canada by T. Rowe Price (Canada), Inc. T. Rowe Price (Canada), Inc.’s investment management services are only available to Accredited Investors as defined under National Instrument 45-106. T. Rowe Price (Canada), Inc. enters into written delegation agreements with affiliates to provide investment management services.

© 2022 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

T. Rowe Price is an asset management firm focused on delivering global investment management excellence and retirement services that investors can rely on—now, and over the long term. Headquartered in Baltimore, Maryland, we provide an array of mutual funds, sub advisory services, separate account management, recordkeeping, and related services for individuals, advisors, institutions, and retirement plan sponsors. At T. Rowe Price, we believe in strategic investing. It has guided how we do business for more than 80 years, and it’s driven by independent thinking and rigorous research. So our clients can be confident that we’ll strive to select the right investments as we help them pursue their objectives. Strategic investing means that we don’t stop at surface level analysis. Instead, we go beyond the numbers. Our investment professionals travel the world, visiting the companies they evaluate. It’s this passion for exploration and understanding that has helped inform better decision-making and prudent risk management for our clients since its founding by Thomas Rowe Price Jr. in 1937.