SPECIAL SPONSORED CONTENT

For years, advisors have been asking Manulife Bank to make its Insured Retirement Program (IRP) available to more clients. In the past, the IRP was only available to clients who owned Manulife life insurance policies. However, Manulife Bank has now opened its IRP up to clients who own whole life insurance policies (including Participating or “PAR” policies) issued by the following major life insurance carriers:

- Manulife

- London Life

- Great-West Life

- Canada Life

- Sun Life

- RBC Insurance

- Industrial Alliance

- BMO Life/AIG

- Ivari (formerly Transamerica)

- Equitable Life

- Empire Life

- Desjardins Insurance

An IRP adds a unique form of diversification. Why? Because an IRP doesn’t respond to changes in market conditions like other elements in a retirement portfolio. Withdraw funds from an equity mutual fund in a bear market and you could lock in your losses. Withdraw funds from a bond fund when interest rates are rising and you could also lock in losses.

The cashflow provided by an IRP is unaffected by such changes. There is no possibility of adverse timing. You don’t withdraw funds from the value of the underlying investment – the CSV. You simply use the CSV to secure a line of credit.

Since John Sample2 retired at age 60, he has discovered a new passion for travel and is planning cruises and other adventures far into the future. He wants to supplement his retirement income without burdening his investment portfolio too much. His advisor suggests an IRP.

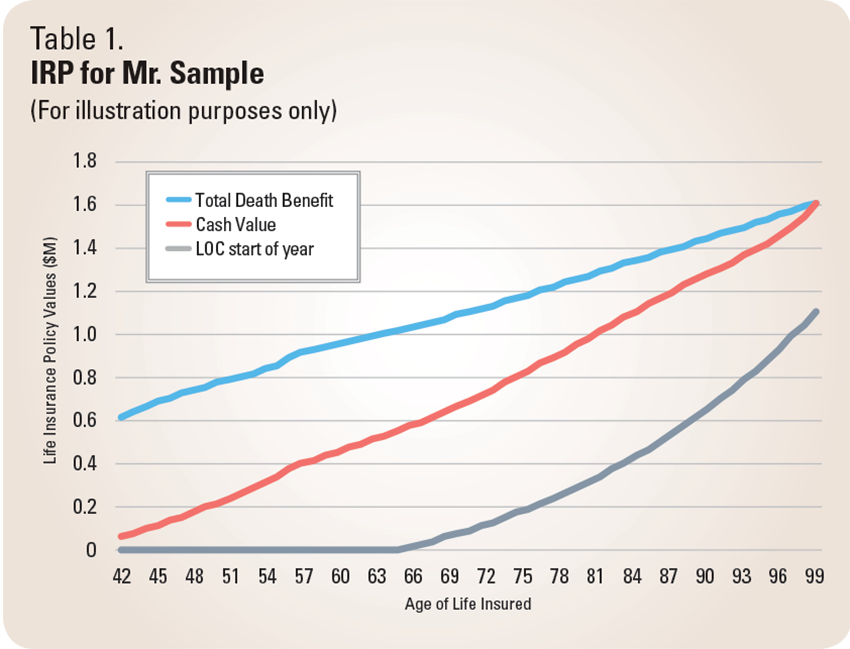

Table 1 shows the projected relationship between his life insurance illustration and his IRP line of credit.3 The blue line is the death benefit. The orange line is the CSV, which gradually approaches the death benefit and, in this case, becomes identical to the death benefit at age 100. The gray line shows the projected use of John’s IRP line of credit, including capitalized interest.

John’s advisor arranges for a monthly payment of $1,100 from his IRP line of credit into his bank account, starting at age 65. John remains well within his credit limit, right up until age 100.

John is a little concerned about what the IRP will do to his death benefit.

After all, he took out the life insurance policy to leave a legacy for his children.

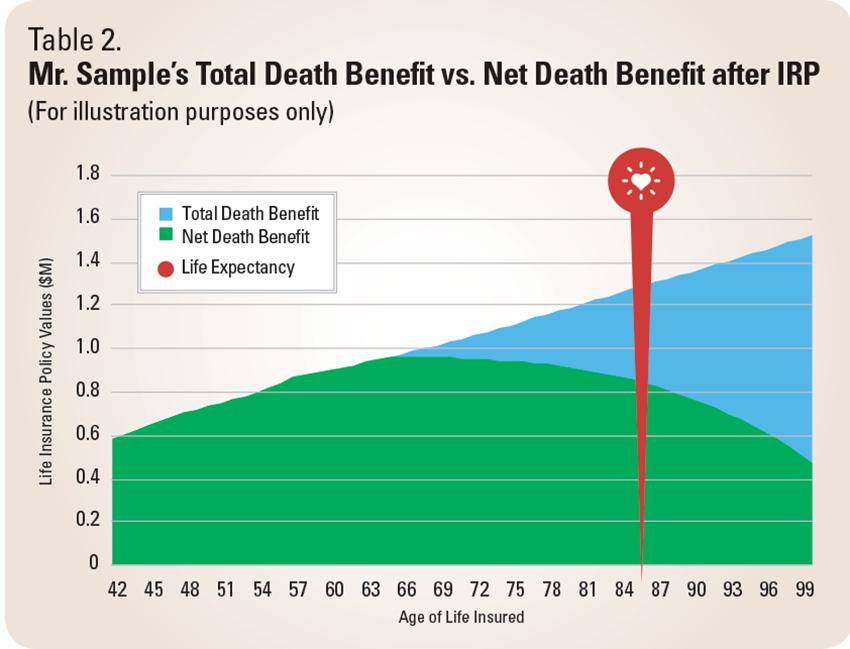

The blue shaded area in Table 2 projects John’s use of his IRP line. And the green shaded area shows the Net Death Benefit, after taking into account what he has borrowed against his IRP.

At age 65, when he opens his IRP, his Net Death Benefit is $965,000. The projected Net Death Benefit at his life expectancy, age 86, is $845,000. The reduction in death benefit is acceptable to him. And he likes the fact that if he lives well past life expectancy the IRP will continue to provide him with a stream of income.

“It’s a good way to diversify your retirement planning.”

Richard, from PEI

“I was in need of some cash and rather than access more illiquid sources, chose to set up an IRP to access some of the cash I’d been putting into my Life Insurance plan.

”

Colin, from Ontario

“I would say it’s an ideal plan and I have always been happy with it. It was easy setting it up also.”

Paul, from BC

Don’t other banks offer lines of credit secured by the CSV of whole life policies? Certainly, some do. But there are three things that make Manulife Bank’s IRP unique:

- The IRP allows clients to capitalize interest. That means interest accumulates within the line of credit. A client receives cashflow from the IRP but does not need to pay monthly interest out-of-pocket.

- The approval process is straightforward, involving an application form and a clean credit bureau. There is no income test. Income tests for credit lines can be problematic for retirees who, after all, are no longer earning active income.

- As long as a client remains within their credit limit, Manulife Bank expects the IRP will be repaid upon death. Of course, a client is free to repay the IRP line of credit at any time, without penalty. But there is no requirement for it be repaid prior to death.

What is an IRP?

An IRP is an interest-capitalizing line of credit secured by a whole life policy issued by a major life insurance carrier approved by Manulife Bank. An IRP can provide a stream of supplementary income during retirement. A client must be 50 years of age to apply. Manulife Bank will establish a line of credit at 75% of the Cash Surrender Value (CSV) of a whole life policy. 1.

What is the minimum line of credit limit?

The minimum line of credit limit is $25,000. Our Loan to Value is 75%. So that means a client would need at least $33,333 in a whole life policy in order to establish an IRP.

Does Manulife Bank offer corporate IRPs?

Yes. Manulife Bank has been offering corporate IRPs for many years, as well as personal IRPs secured by corporate insurance policies.

What if a client is younger than 50 years old?

For clients under 50, Manulife Bank also offers the Access Line of Credit (ALOC), secured by the CSV of whole life policies issued by the same life insurance carriers listed above. Clients under 50 will need to pay interest on a monthly basis.

GRAHAM CARTER,

President & CEO, CAP Advisors Inc.

“When clients commit large amounts of capital to a life insurance policy, they always ask if the money can be accessed during retirement, if needed. Most of our clients have not drawn down on their IRP lines, but they are happy knowing that the liquidity is accessible. Several clients have used the IRP to fund investments, while others have used the IRP to bridge cash flow problems. One very high-net-worth client had an unexpected liquidity problem and used the IRP to fund living expenses for several months.

Most of the big five banks are trying to match Manulife Bank’s IRP, which is definitely the industry standard for leveraging life insurance… these competitors simply do not understand life insurance as well as Manulife Bank and have not been in the game long enough to see the issues that can arise. Experience is critical in this market.”

PATRICK TARGOSZ ,

President, Mo Targosz Financial

“I have been setting up IRP lines for my clients since 2013 for many different purposes. Some clients just use it for retirement income, in which case the IRP provides tax benefits in comparison with RIF income. Others have used the IRP to invest in other opportunities and paid the interest (instead of capitalizing), so deductibility of interest was an added bonus. And I used an IRP to help fund premium payments on another policy.”

2 Sample cases for illustrative purposes. The persons and situations depicted are fictional and their resemblance to anyone living or dead is purely coincidental. This media is for information purposes only and is not intended to provide specific financial, tax, legal, accounting or other advice and should not be relied upon in that regard.

3 The life insurance data is derived from a whole life insurance illustration created by one of Manulife Bank’s approved life insurance carriers.

The Insured Retirement Program is offered through Manulife Bank of Canada.

Manulife Bank, Manulife Bank & Stylized M Design, and Stylized M Design are trademarks of The Manufacturers Life Insurance Company and are used by Manulife Bank under license.

For more information on this flexible retirement product please contact your Manulife Bank Business Development Consultant or call us to put you in touch with one 1-855-518-7546!