Structured notes were typically recognized as niche, highly customized solutions. Why did BMO GAM choose to launch a fully managed exposure to this asset class?

Managing Director, Co-Head of Intermediary Distribution

BMO Global Asset Management

AP One reason—investors asked for it. The market for structured notes is growing rapidly, but so too are the challenges for individual Advisors. More than 100 to 150 new notes are issued each week in the Canadian market, and managing all of a client’s positions can be difficult. We heard these challenges loud and clear in our conversations and thought there might be a more efficient solution. The BMO Strategic Equity Yield Fund (SEYF) was designed to help Advisors provide their clients access to the benefits of structured notes without the additional burdens associated with managing a large number of issuances.1

Moreover, many Advisors did not have access to these highly customized solutions. Individual notes have typically been reserved for high-net-worth individuals and IIROC advisors. But with the introduction of SEYF, we hope to widen access to this rapidly growing asset class and open the door to all.

CM The Fund is also evergreen, which ensures greater consistency across client portfolios. For example, if you onboard a new client tomorrow, SEYF puts them on the same track as the clients who came before. If one of your existing clients contributes more assets, you don’t need to scour the universe of notes for an appropriate fit. You can simply invest the dollars evenly with previous contributions. All of the assets go to the same Fund, with the same risk and reward characteristics as before.2 Individual structured notes, on the other hand, work on a subscription-based model. Which means once the selling period is over, the Advisor is unable to add to that allocation again.

We also learned from Advisors that individual note buyers can suffer from “line-item fatigue.” Keeping track of coupon dates, call dates and strike prices is tedious and time-consuming. One of the reasons we launched the Fund was remove the hassle of managing structured notes, giving you the opportunity to instead focus on the larger issues of portfolio construction, client servicing, and prospecting.

The BMO Strategic Equity Yield Fund

Can you explain why some investors and Advisors were historically shut out of this market?

AP Sure. Since their inception in the 1990s, structured notes have rarely been broadly offered. One of the main barriers to entry was cost. It can be expensive to build, distribute and monitor individual notes, which is why they were only available to IIROC Advisors or ultra-high-net-worth investors.

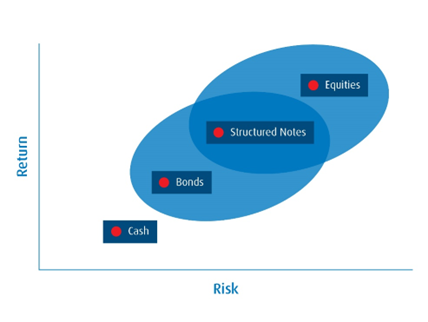

During the same period, the idea of a standard portfolio of 60% equities and 40% fixed income came into question. Remember, interest rates were historically low and investors were looking for new and innovative solutions. Income-focused structured notes happened to sit somewhere between stocks and bonds—a sweet spot between the traditional asset classes—which meant they could provide a useful form of diversification. However, the cost barrier still needed to be lower in order for more Canadian investors to have access.

This is why we launched SEYF. The format is easy to access and use, plus mutual funds come in multiple series and purchase options to better align with the Advisor’s practice model. Most importantly, a mutual fund offers economies of scale. The ability to pool assets with a dedicated team of structured product experts delivers efficiencies not only on cost, but also on workflow.

Chris, can you explain on how the BMO Strategic Equity Yield Fund is constructed?

CM The Fund replicates exposure to a basket of autocallable coupon and memory notes,3 two of the most popular and well-established kinds of structured notes in the Canadian market. The term “autocallable” simply refers to the fact that the note will be redeemed if certain conditions are met; for example, the note could specify that a market increase of 5% would automatically redeem the contract. This would force the holder to reinvest their returns in another note with comparable risk-return characteristics. Typically, an Advisor buying individual notes would have to do this themselves, but with SEYF, the dollars simply roll over within the Fund.

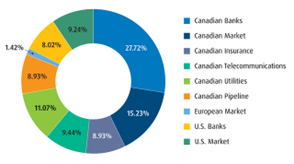

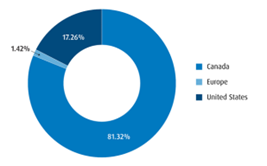

From a sectoral standpoint, the Fund is well diversified across financials, telecoms and utilities. And while the allocation is heavily tilted to North America, there is also some European index exposure for some additional diversification. The goal is to not only replicate exposure to a wide assortment of structured notes, but also to spread out the underlying reference assets so that our eggs are in many different baskets. Markets are always moving, and our job is to generate consistent yield while mitigating downside risk in any one particular area.

Reference Asset Exposure and Regional Exposure*

Source: BMO Global Asset Management as of February 12, 2024.

*Reference Asset and Regional Exposure refer to the underlying benchmark exposure from the Total Return Swaps held by the Fund.

Finally, from an allocation standpoint, how should Advisors position the BMO Strategic Equity Yield Fund in a client’s portfolio?

CM The BMO Strategic Equity Yield Fund is all about delivering stable cash flows. That’s how we define success for this Fund. Rather than trying to beat the benchmark, the goal is to target a high level of distributions while maintaining a low to medium risk rating. Since launching in June 2023, the Fund has consistently delivered a monthly distribution yield that tracks toward the 8% annual target4—an inflation-beating income source that is differentiated from traditional fixed income. We expect that investors seeking higher income from their portfolios will likely be drawn to this strategy, as will those who want to reduce their overall portfolio risk without impacting their yield generation. In other words, Advisors may choose to reallocate anywhere from 5 to 15% of either their bond or equity sleeves. Both scenarios work well, because in either case the objective is to add an elevated yield exposure without taking on a substantial amount of risk to your client portfolios.

For more information on the BMO Strategic Equity Yield Fund, contact your Regional BMO Global Asset Management Representative.

1 The BMO Strategic Equity Yield Fund will focus on replicating exposure to notes focused on income generation, while also maintaining contingent downside protection.

2 Risk is defined as the uncertainty of return and the potential for capital loss in your investments.

3 Autocallable notes are a subset of structured notes that seek to provide enhanced yield plus contingent downside protection. The autocallable note exposure in the fund is currently obtained through the use of total returns swaps, which replicate the exposure of a portfolio of autocallable notes.

4 Target annualized distribution is for Series F. The target distribution yield was calculated by using the most recent regular distribution, or expected distribution, (which may be based on income, dividends, return of capital, and option premiums, as applicable) and excluding additional year end distributions, and special reinvested distributions) annualized for frequency, divided by current net asset value (NAV). Distribution yield is not an indicator of overall performance and will change based on market conditions, NAV fluctuations, and is not guaranteed. As of January 31, 2024.

Disclosures:

IMPORTANT DISCLAIMERS

FOR ADVISOR USE ONLY.

Distribution yields are calculated by using the most recent regular distribution, or expected distribution, (which may be based on income, dividends, return of capital, and option premiums, as applicable) and excluding additional year end distributions, and special reinvested distributions annualized for frequency, divided by current net asset value (NAV). Distributions are not guaranteed, may fluctuate and are subject to change and/or elimination. Distribution rates may change without notice (up or down) depending on market conditions and NAV fluctuations. The payment of distributions should not be confused with a BMO Mutual Fund’s performance, rate of return or yield. If distributions paid by a BMO Mutual Fund are greater than the performance of the investment fund, your original investment will shrink. Distributions paid as a result of capital gains realized by a BMO Mutual Fund, and income and dividends earned by a BMO Mutual Fund, are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero.

Distributions, if any, for all series of securities of a BMO Mutual Fund (other than ETF Series) are automatically reinvested in additional securities of the same series of the applicable BMO Mutual Fund, unless the securityholder elects in writing that that they prefer to receive cash distributions. For ETF Series securities of a BMO Mutual Fund, distributions, if any, may be paid in cash or reinvested automatically in additional ETF Series securities of the applicable BMO Mutual Fund and the ETF Series securities will be immediately consolidated such that the number of outstanding ETF Series securities following the distribution will equal the number of ETF Series securities outstanding prior to the distribution. If a securityholder is enrolled in a distribution reinvestment plan, distributions, if any, will be automatically reinvested in additional ETF Series securities of the applicable BMO Mutual Fund pursuant to the distribution reinvestment plan. For further information, see the distribution policy for the applicable BMO Mutual Fund in the simplified prospectus.

No portion of this communication may be reproduced or distributed to clients as it may not comply with Sales Communications requirements.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The information in this trade idea is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

This communication is intended for informational purposes only and is not, and should not be construed as, investment and/or tax advice to any individual. Particular investments and/or trading strategies should be evaluated relative to each individual’s circumstances. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment.

The BMO Strategic Equity Yield Fund will focus on replicating exposure to notes focused on income generation, while also maintaining contingent downside protection. Our dedicated team of structured product professionals seeks to achieve above market returns and exposure to North American and/or global equity markets through the use of derivatives and/or structured products.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.