PAID CONTENT

President, Russell Investments Canada

Russell Investments has always believed in the importance of financial advisors. We believe your role as a guide through a client’s investing journey—turbulent market environments, major life changes, evolving needs and goals—has significant value.

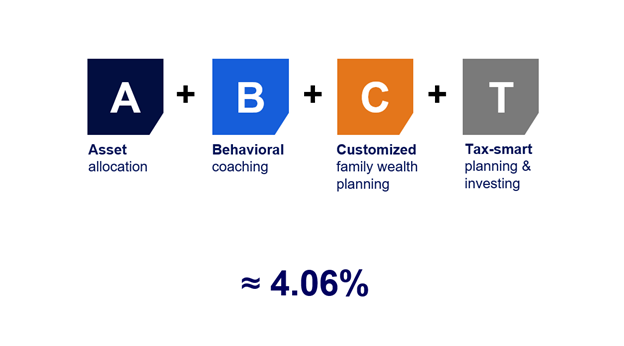

Every year we take a closer look at that value using the simple formula we have updated annually for the past 10 years. And every year we find the value you provide is higher than the fee you charge. Here is the result of our 2025 study:

We’ve refined our formula over time as the role of an advisor has evolved. No longer just stockbrokers, many of you not only create and continually review an individualized financial plan, you provide customized wealth management services for entire families. Often, you are supported by a network of experts in their fields.

In our decade of conducting this survey, we have found the value of an advisor has increased as the various roles they play have broadened and deepened.

Our 2025 Value of an Advisor formula consists of four key elements in an advisor’s total value proposition: asset allocation to ensure the investor’s portfolio is designed to meet their financial goals while remaining aligned to their risk profile, their role as a behavioral coach to keep clients invested through thick and thin, customized wealth planning to guide their clients and families through the many stages of their financial life, and tax-smart planning and investing to help investors keep more of what they earn.

Asset Allocation

An advisor will work with their clients to determine the optimal mix of assets to help them reach their financial goals at an appropriate level of risk. They will work to keep their clients fully invested in order to take advantage of market opportunities, and ensure they diversify their risk and return.

Behavioral Coach

An advisor will ensure that clients stick to their chosen investment path and keep them aligned with their financial goals. They’ll keep an investor’s impulses in check, especially when markets are volatile. Left on their own, many investors try to time the market, which could lead to missing out on rebounds.

Customized Family Wealth Planning

An advisor can build an individualized investment plan, then regularly update it to align to an investor’s changing needs. They can adjust the plan when one of life’s big moments happens. And they don’t just consider their clients’ personal goals and needs, but also those of the spouse and children and perhaps even those of future generations.

Tax-Smart Planning and Investing

An advisor can help investors navigate the complex world of taxable and non-taxable accounts and how they fit in an investment portfolio. Advisors can play the important role of choosing tax-conscious investments, meant to reduce or potentially eliminate the impact taxes can have on their clients’ investments.

Want more details?

Learn more about the calculations behind our formula. Get the Russell Investments 2025 study today.

These views are subject to change at any time based upon market or other conditions and are current as of the date at the top of the page. The information, analysis, and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual or entity.

This material is not an offer, solicitation or recommendation to purchase any security.

Forecasting represents predictions of market prices and/or volume patterns utilizing varying analytical data. It is not representative of a projection of the stock market, or of any specific investment.

Nothing in this publication is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. This information is made available on an “as is” basis. Russell Investments Canada Limited does not make any warranty or representation regarding the information. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional.

Please remember that all investments carry some level of risk, including the potential loss of principal invested. They do not typically grow at an even rate of return and may experience negative growth. As with any type of portfolio structuring, attempting to reduce risk and increase return could, at certain times, unintentionally reduce returns.

Russell Investments is the operating name of a group of companies under common management, including Russell Investments Canada Limited.

Russell Investments’ ownership is composed of a majority stake held by funds managed by TA Associates Management, L.P., with a significant minority stake held by funds managed by Reverence Capital Partners, L.P. Certain of Russell Investments’ employees and Hamilton Lane Advisors, LLC also hold minority, non-controlling, ownership stakes.

Frank Russell Company is the owner of the Russell trademarks contained in this material and all trademark rights related to the Russell trademarks, which the members of the Russell Investments group of companies are permitted to use under license from Frank Russell Company. The members of the Russell Investments group of companies are not affiliated in any manner with Frank Russell Company or any entity operating under the “FTSE RUSSELL” brand. Copyright © Russell Investments Canada Limited 2025. Date of first use: July 2025 RETAIL-04466