SPECIAL SPONSORED CONTENT

Investment in real assets is a proven means of portfolio diversification and complements more traditional equities and fixed income assets. This has become more relevant with the evolving objectives of large institutional investors (such as pension funds) in response to recent developments in world economies and markets. Investments in real assets such as infrastructure and real estate are attractive because they provide exposure to different combinations of growth potential, value creation and risk, while also providing reliable income streams.

The way in which institutions access these investments continues to evolve as well. A large portion of high-quality real estate and infrastructure assets remain in the private market as the burden of public ownership, and the quarterly earnings spotlight, intensifies. This migration of critical assets to private markets makes practical access extremely difficult for investors who lack a structured investment approach and large amounts of capital.

“With respect to industrial real estate, we’ve been focused for several years on holdings whose tenants are logistics and distribution types of businesses that provide the infrastructure that facilitates the demands from growing e-commerce activity.” – Dean Orrico

For further insights, we caught up with the specialists at Middlefield Group, a recognized authority in real estate and infrastructure investment. Dean Orrico, President and Chief Investment Officer, and Robert Lauzon, Managing Director and Deputy Chief Investment Officer, shared their views of the benefits of real asset investments and ongoing developments in the sector.

Interest rates and a renewed focus on real assets

While real estate and infrastructure represent compelling opportunities in any business or economic cycle, current macroeconomic, market and industry factors are driving increased interest in these investments. One such factor is the frequently discussed environment of low interest rates, which benefits real assets in two key ways.

The first factor that Orrico notes is the impact of low interest rates on leverage. The capital-intensive nature of real estate and infrastructure investment makes the actions of world central banks particularly critical for the continued financing and expansion of such projects. Signals of continued low interest rates, at least in the near term, bode well for real assets in general.

“Given that real estate and infrastructure are generally stable, cash-flow-producing assets that tend to employ some leverage, lower-for-longer rates support higher free cash flows,” says Orrico.

Add to that the appetite of investors for robust income streams in a low-interest-rate environment, says Lauzon, and real assets become even more compelling.

“If interest rates continue to be low and you need cash-flow assets with a growing income stream, real estate and infrastructure typically have escalators in their rents or rate/price agreements,” Lauzon explains. “These real assets become investments that behave somewhat like bonds that generate growing payments, and due to the contractual escalators in those payments, can act as a hedge against inflation.”

Not only do real assets generate cash flow, but they are often characterized as being holdings with a very long lifespan. That makes them especially attractive to institutional investors such as pension funds.

Real Assets Opportunities: Multi-Residential Properties

Worldwide, macroeconomic factors such as rising housing prices, increased urbanization, immigration patterns and population mobility have put considerable upward pressure on rental accommodation.

“From our office in Toronto, we can see the trend toward multi-residential happening in Canada. But it’s also a global phenomenon, happening in major cities throughout North America, Europe and other markets,” reports Dean Orrico of the Middlefield Group. “When you see immigration levels of countries like Germany, for example, or if you examine the high levels of housing prices in the United Kingdom, more and more people with fewer means are looking to rent before buying. We think that’s going to be a very powerful tailwind that will help grow the multi-residential rental market for a number of years.”

“Take a pension fund, for example, that has liabilities that are very long term in nature,” Orrico says. “An investment in real assets, with cash flows that are also long term in nature, naturally aligns with a pension fund’s need for cash flow from its investment portfolio.”

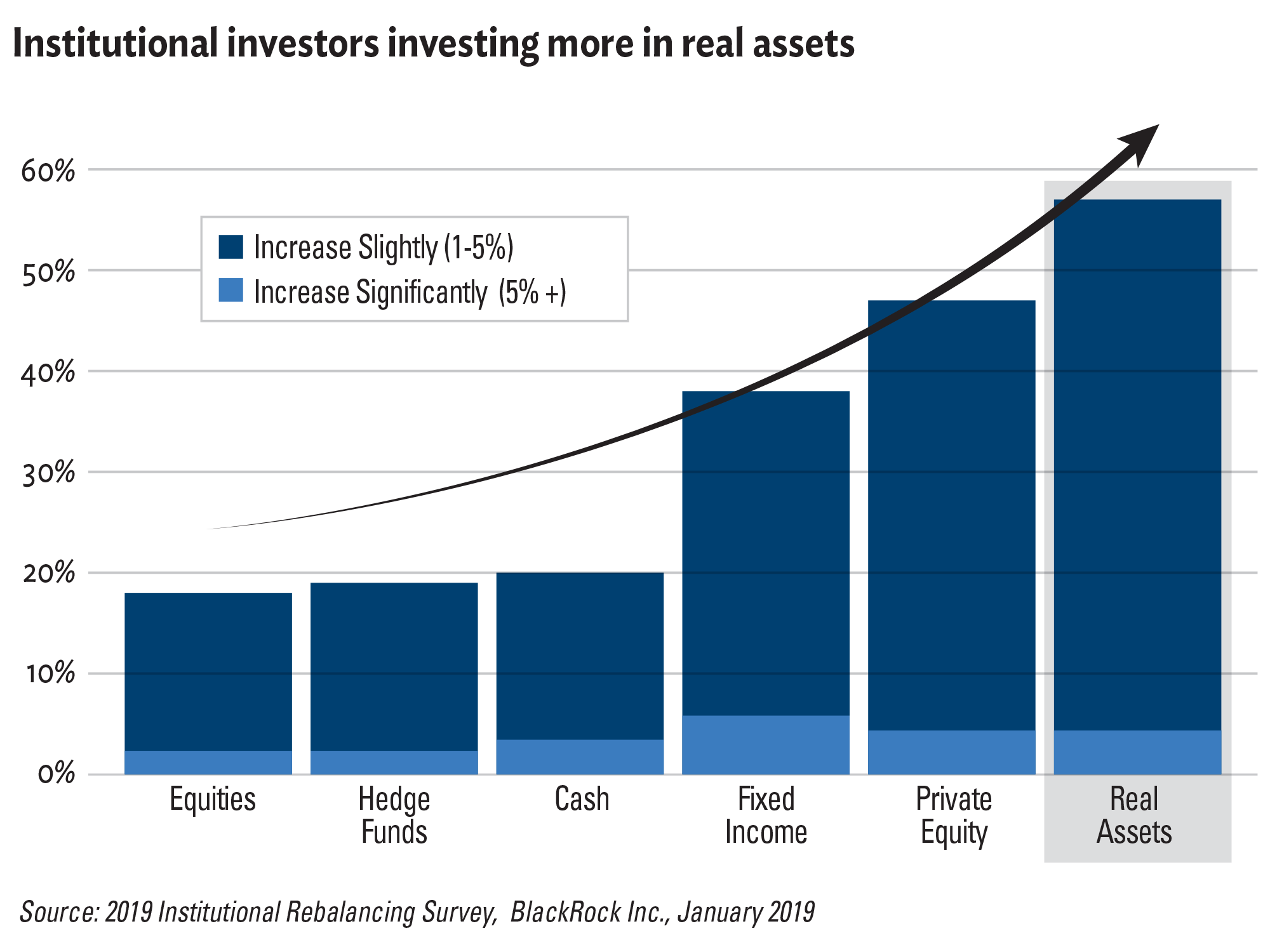

Insights into the moves of institutional investors are particularly useful, not just for the volume of investment assets involved, but for signaling the overall forward direction of the market. Lauzon points to a recent survey of U.S. institutional investors by global asset manager BlackRock, Inc. According to the survey, institutional investors are most likely to increase their allocations to real assets, compared to other asset classes.

Breaking down current opportunities in real assets

It is important to note that real assets represent a highly diverse range of investments. Even within the real estate and infrastructure sectors, there is considerable diversity in the opportunities available in terms of their earnings expectations and prospects for future growth. For example, ongoing shifts in the preferences of consumers and how they make purchases have had a significant impact on the real estate market. A greater focus on e-commerce has Orrico favouring industrial real estate over traditional retail properties, such as shopping malls.

“With respect to industrial real estate, we’ve been focused for several years on holdings whose tenants are logistics and distribution types of businesses that provide the infrastructure that facilitates the demands from growing e-commerce activity,” he says.

“When you think about companies like Amazon, which is really the 800-pound gorilla in e-commerce, they’re still building out their logistics and distribution infrastructure to this day to fulfill their increasing service requirements. A company like Amazon that offers one-day delivery will need additional logistics and distribution facilities near major urban centres.”

Lauzon points to several ongoing and long-time trends that he expects will continue to generate opportunities in both infrastructure and real estate. One example is the expansion of mobile technology, requiring both property and infrastructure by tower companies to expand their capabilities in both developed and emerging markets. The growth of data centres is another related area of considerable opportunity.

The benefits of private equity investment

Another important distinction in real assets investing is in the structure of the investments themselves. Private equity investments are different in nature to strategies that focus only on publicly traded real asset investments, and can offer unique benefits to the investor.

Private equity real asset returns can be driven by significantly different factors than their publicly traded counterparts, Orrico explains. Share prices of publicly traded securities can be impacted, positively or negatively, by quantitative or algorithmic trading, short-term shareholder concerns, short-term reactions to geopolitical events and/or compliance issues. Companies in the private equity space, on the other hand, typically have greater flexibility and are more focused on long-term growth, he says.

“If you’re a private equity investor, you likely have direct representation on the (company) board. From there, you can help enact operational efficiencies, drive positive change, and gain greater access

to information because you are part of the company as a strategic investor.” – Robert Lauzon

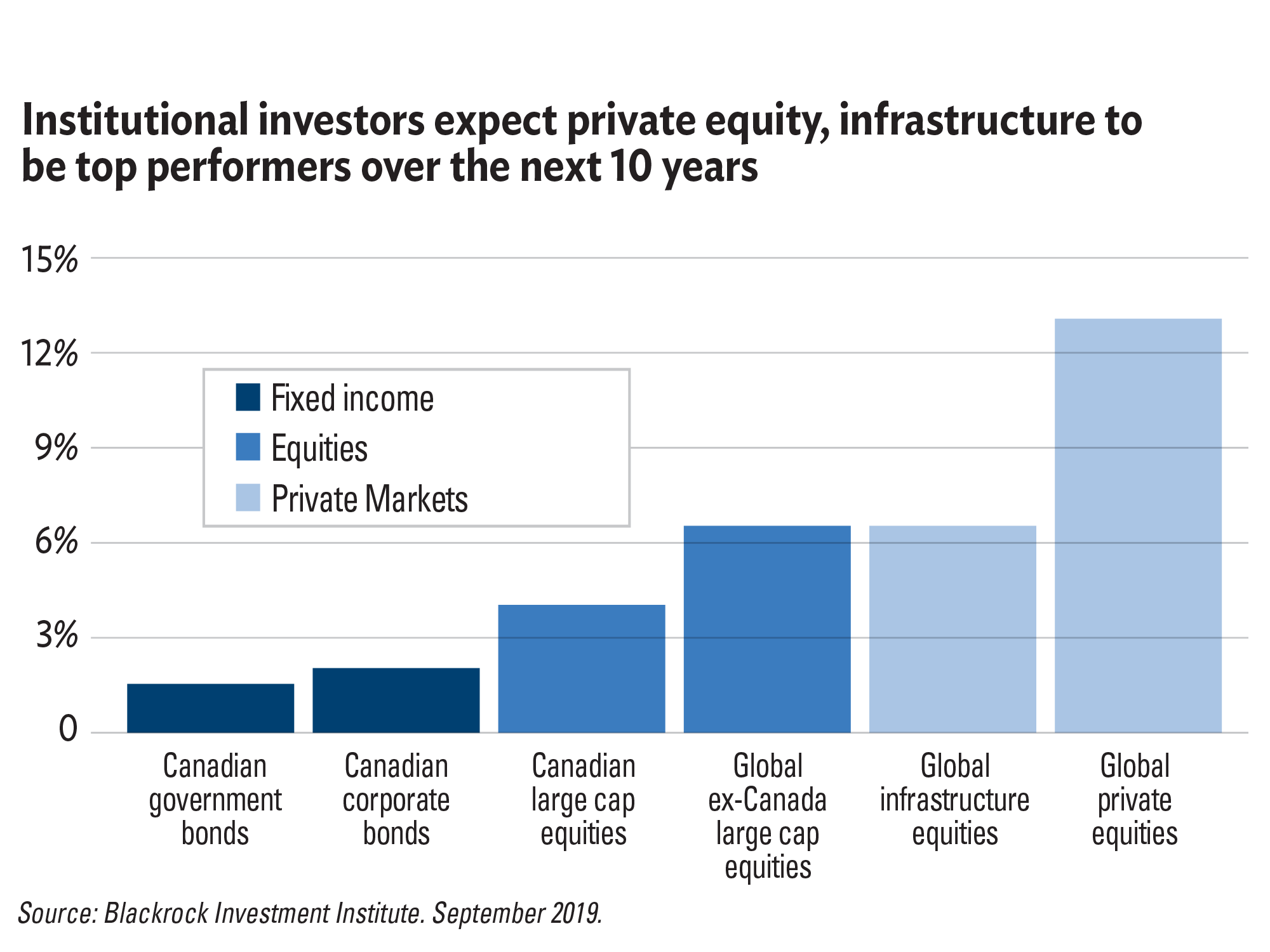

“Historically, private real assets, whether real estate, infrastructure or other types of investment, have actually shown an ability to generate very competitive total returns compared to publicly traded securities,” Orrico notes. “Even on a forward-looking basis, there was a recent institutional investor survey done by BlackRock that reported the expectation is for private equity and infrastructure to generate better returns than both traditional equities and fixed income over the next 10 years.”

The addition of private real assets exposure to a portfolio can also reduce its overall volatility, Lauzon adds. Private equity and real assets both have low historical correlations to traditional equities and fixed income. Furthermore, exposure to a private equity fund means exposure to a manager who likely has a more direct ability to effect positive change and increase investor value in a given company.

“If you’re a private equity investor, you likely have direct representation on the board,” says Lauzon. “From there, you can help enact operational efficiencies, drive positive change, and gain greater access to information because you are part of the company as a strategic investor.”

Investing with the right real asset manager

For individual investors and their advisors, gaining exposure to the most compelling real estate and infrastructure opportunities can be a challenge. Investment minimums can be high even for a wealthy client, and the initial lock-up period can be a potential negative for many investors. Investing in real assets, especially through private equity opportunities, is often best done through a specialized investment manager.

Selecting the right manager is key, says Orrico, and critical attributes an investor or advisor should look for include a firm’s track record, ability to leverage economies of scale, an alignment of interest between investors and the firm’s principals, and specific areas of expertise. It is these attributes that Orrico believes drives Middlefield Group’s position as a standout manager in the real assets sector.

“We have a long history in the real estate and infrastructure area. When Middlefield was founded over 40 years ago, we were focused on real estate and, along with infrastructure, that continues to be our core competency.”

Real Assets Opportunities: Elder and Health Care

One critical trend that Robert Lauzon of the Middlefield Group is watching closely is the aging population in developed economies. He expects that increases in health care spending will have significant impacts on both real estate and infrastructure. In particular, he is closely observing Europe’s demographics, in which it is expected that retirees will soon outnumber the working population.

“These demographics are driving some very compelling investment ideas, whether in real estate because of the need for nursing homes, or the need for upgraded public health care infrastructure.”

A good example of the firm utilizing its industry expertise and scale to benefit investors is the recent launch of the Middlefield Global Real Asset Fund, a strategy that leverages a newly initiated partnership with The Blackstone Group, an alternative investment leader. The Fund is an actively managed solution that combines investment in both publicly traded real asset securities and private limited partnership investments, for truly diversified exposure to the broad real assets sector.

“I recently came out of a meeting with a client. They told me they want income and low volatility, and they don’t want the whipsaw effects they’ve been seeing, when the Dow Jones Industrial Average goes down 400 points because of something on Twitter,” says Lauzon.

“Our clients want exposure to good-quality companies with low volatility and income generation. That’s what we’ve been seeing in the investment market, and is the crux of the solutions we provide.”

For more information about Middlefield Global Real Asset Fund or Middlefield Group, visit www.middlefield.com.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. You will usually pay brokerage fees to your dealer if you purchase or sell units of investment funds on the Toronto Stock Exchange or other alternative Canadian trading system (an “Exchange”). If the units are purchased or sold on an Exchange, investors may pay more than the current net asset value when buying and may receive less than the current net asset value when selling them. There are ongoing fees and expenses associated with owning units of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in these documents. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.