SPECIAL SPONSORED CONTENT

As the financial service industry evolves, clients are expecting more for the fees they pay, and advisors need to demonstrate the value they bring to the process. That value has always been advice, and today, advice is changing.

Hugh Moncrieff is the executive vice-president of advisory network and industry affairs at Great-West Life, London Life and Canada Life. He says the future of advice is less about insurance and investments, and more about the relationship between advisors and their clients. Valuable relationships are built through the engagement that happens when the advisor offers thorough needs analysis, advice, recommendations, and ongoing support and review of the client’s financial plan.

This shift in the advisor-client relationship model, from transactional engagement to planning to attain specific financial goals, represents an opportunity to demonstrate enhanced value to consumers. A 2012 study puts real numbers to that claim. A Canadian study from the Center for Interuniversity Research and Analysis of Organizations (CIRANO) showed that, over a 15-year period, people who worked with an advisor had 173% more assets than those who didn’t. Similarly, people who stopped working with an advisor saw a 34% reduction in their assets over a two-year period of extreme market volatility. Conversely, those who continued to work with an advisor saw an additional 26% increase in their investments in the same period.

Moncrieff compares the shift from a transactional focus to a planning focus to the difference between a travel agent and a tour guide. “People can easily book a flight to Toronto or Calgary on the web or through a travel agent but if their goal is to experience a river cruise through Europe or a wine tour in Napa Valley, they are well served by someone who can guide them or specializes in understanding and meeting their needs and goals.”

Change the focus – change the conversation

To support a planning-based advice model, advisors should be taking a goals-based approach to investing with their clients, according to Paul Orlander, executive vice-president, individual customer at Great-West Life, London Life and Canada Life.

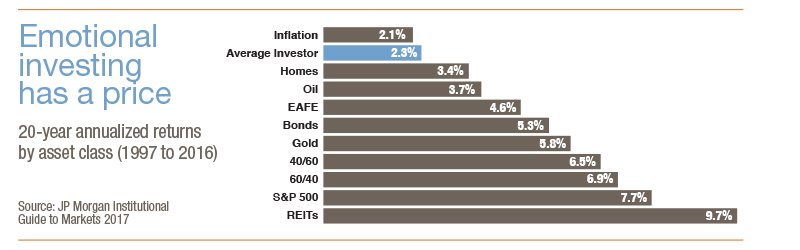

He points to human behaviour as the trigger that most often derails a financial plan. “Investor behaviour is reactionary. Over the last 20 years, the average investor saw an annualized return of 2.3%, just above inflation at 2.1%. That’s not great, and it’s largely because investors chase returns instead of taking a long-term approach. A good advisor will add to the value of a portfolio simply by helping clients recognize that short-term noise is different from long-term objectives.”

Click on the chart to expand it.

The goals-based approach isn’t new. It’s a more sophisticated version of a common-sense approach to managing household finances. By creating a separate portfolio for each goal, it’s possible to customize allocations to different time horizons and risk levels. Orlander explains how goals-based investing takes advice to the next level. “The industry talks about risk and volatility. This approach focuses instead on personal goals. It allows the advisor to tailor the conversation so that the client can speak in their own language to identify their investing goals. That way, the advisor and the client create a strategy in a language the client understands.”

“Clients who work with an advisor who takes a goals-based approach to planning will see more value in the relationship and be more likely to stay engaged in that relationship for the long term.” – Hugh Moncrieff

That co-creation is the foundation of the successful plan. Clients are more likely to stay the course when they’ve engaged in creating the plan, and they see progress toward a goal they have set.

By taking risk and volatility out of the conversation, the focus changes to the reward and that helps

clients keep their focus on their ultimate objectives, not market performance.

Goals-based investing allows advisors to have meaningful conversations with clients and lets them play an active part in saving for their futures. It modernizes the way advisors engage with their clients, Orlander explains. “By combining goals-based investing into a managed program with features such as a disciplined asset allocation strategy and a sophisticated, automated rebalancing engine, it frees up advisor resources, so they can focus on what’s important for their practice: maintaining client relationships and building their book.”

“On a road trip, you need a destination, a driver and a vehicle to get you there. With a responsible driver in a vehicle equipped with a GPS to help navigate through traffic, you are more likely to get to your destination on time. Using goals-based investing together with a managed program, advisors are now fully equipped to help their clients achieve their goals.” – Paul Orlander

Defining the value of advice

Moncrieff points out that cost is only an issue in the absence of value. “We have to get sharper at how we express and demonstrate our value,” he says. “Fee transparency is not just a regulatory onus, it’s an opportunity to clearly define value. A goals-based investing approach and managed program is a unique client experience that’s more likely to help clients reach their goals, and that is valuable to them.”

This approach recognizes the big picture of financial security. “As part of the social fabric of communities across Canada, advisors help Canadians realize their goals and secure their financial futures. Advice is foundational to client success,” Moncrieff says.

Hugh Moncrieff,

Executive vice-president of advisory network and industry

affairs at Great-West Life,

London Life and Canada Life

Paul Orlander,

Executive vice-president,

individual customer at Great-West Life,

London Life and Canada Life

London Life Constellation Managed Portfolios, London Life and design are trademarks of London Life Insurance Company. February 2019.