SPECIAL SPONSORED CONTENT

RESPONSIBLE INVESTMENT

AIMS TO BE A LEVER FOR CHANGE

How are advisors using ESG to select and manage investments?

That’s on the minds of more and more people, as they’re always looking for solid returns. Yet a growing number also want to back companies that are progressive when it comes to environmental, social, and governance (ESG) criteria.

Responsible investing (RI) is a way to try achieving both. Driven by investor demand and a strong track record, RI is rising in popularity.

In a survey conducted for Desjardins Wealth Management, 63% of respondents said they were willing to allocate a portion of their investments to RI 1. With that high interest, advisors can benefit by educating their clients (and themselves) about RI.

“These portfolios are designed for those who aim to see their investments grow, while supporting businesses that promote sustainable development and respect social and human responsibilities,” says Denis Dion, RI Funds Product Manager at Desjardins.

Research shows that investors and their advisors aren’t making a trade-off when they choose RI. What they’re doing is integrating ESG in the selection and management of investments. That includes looking closely at a company’s objectives, the means to achieve them, and the results regarding any number of ESG factors. Among these factors are the following:

ENVIRONMENTAL: climate change, energy management, biodiversity, water footprint, water access and sustainable use, product safety, product lifecycle.

SOCIAL: partnerships/trade with First Nations, child labour, worker compensation and rights, employee health and safety, privacy protection, cybersecurity, community relations.

GOVERNANCE: executive compensation, performance bonuses, boardroom diversity, board independence, ethics, supply chain management, shareholder rights, political contributions.

“Before being selected as part of an RI strategy, companies undergo a review of their ESG practices, as well as an in-depth financial analysis, to ensure they’ll offer value to investors,” says Dion.

Beyond a desire to support companies with a strong ESG record, is there a connection between that and financial returns?

The Responsible Investment Association (RIA) thinks so. In its Canadian trends report, it noted that ESG factors can help to identify superior management practices and teams, tending to lower risk to investors and to improve long-term performance. At the very least, the RIA says, RI is no more risky than traditional investing.

Many studies bear that out. For mutual funds and guaranteed investments, independent analyses show that RI products offer comparable returns to traditional products of the same type. In many cases, studies show a link between RI and enhanced long-term returns.

For example, the RIA report cites studies by the Morgan Stanley Institute for Sustainable Investing and OceanRock Investments found that RI equity funds outperformed their benchmarks more than 60%

of the time, at lower levels of risk.

“These portfolios are designed for those who want to see their investments grow, while supporting businesses that promote sustainable development and respect social and human responsibilities.”

Denis Dion, RI Funds Product Manager at Desjardins

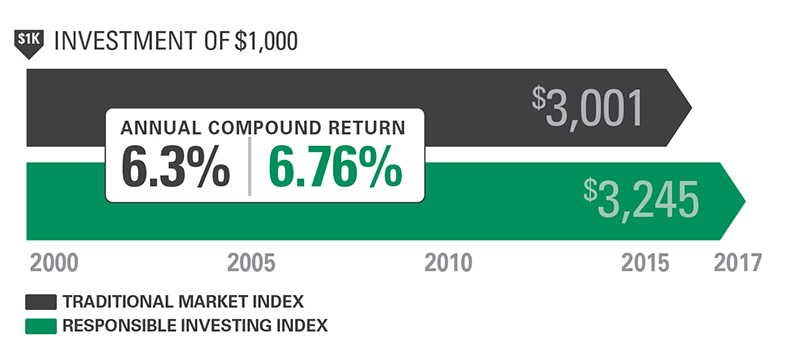

Another study by George Serafeim and Robert Eccles3 at Harvard Business School found that financial markets value firms that incorporate sustainability practices into their operations. High-sustainability firms (those that actively incorporated ESG criteria into decision-making) significantly outperformed their low-sustainability counterparts by 46% over 17 years. One socially responsible index, the Jantzi Social Index,4 has performed just as well as (if not better than) the S&P/TSX 60 Index. From 2000 to 2017, an investment of $1,000 would have grown to $3,001 in the traditional market index, an annual compound return of 6.3%. The RI index showed a slightly higher return of 6.76%, for a total of $3,245 on the same $1,000.

A review of more than 2,000 studies published since 1970 showed a neutral or positive relationship between ESG criteria and financial performance 90% of the time5.

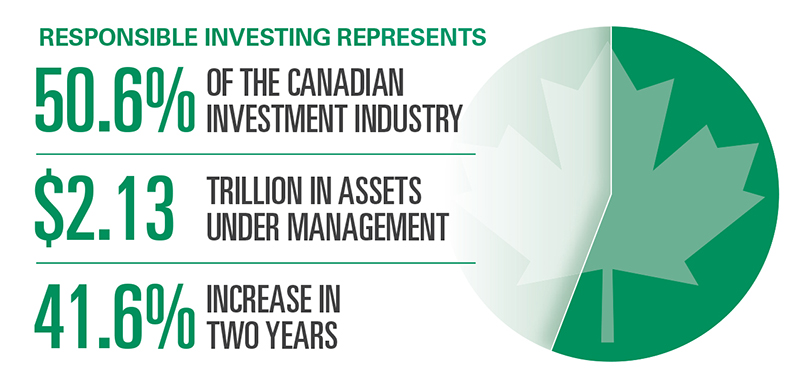

In Canada, the RI sector is growing rapidly, mostly driven by institutional investments. The latest RIA trends report6 shows that RI already represents 50.6% of the Canadian investment industry, with $2.13 trillion in assets under management That represents a 41.6% increase in two years.

In an RIA survey, 87% of respondents expect to see continued moderate-to-high growth in RI. The survey found that asset managers and owners have three main motivations for incorporating ESG factors into investment decisions: to minimize risk; to improve returns; and to fulfill fiduciary duty.

The focus on financial performance doesn’t surprise Rosalie Vendette, ESG Practice Leader at Desjardins. “The evaluation of companies’ ESG practices is to measure risks and their impact on asset value over the long term,” she says.

While RI is growing, it isn’t new. Desjardins has been an RI pioneer since launching its first environment fund in 1990. Today, Desjardins offers two dozen RI products, with diversified strategies, to suit different investor profiles, interests, and needs. That includes a variety of income, growth, and low-volatility funds.

At Desjardins, the objective of RI is to participate in the improvement of practices in sustainable development and corporate social responsibility. Desjardins uses exclusion screening to filter out a few sectors such as weapons and tobacco. Those are off limits. However, with one fossil-free exception, no economic sector is excluded from the Desjardins RI funds. People still have access to a wide range of investment options.

“The evaluation of companies’ ESG practices is to measure risks and their impact on asset value over the long term.”

Rosalie Vendette, ESG Practice Leader at Desjardins

Desjardins sees RI as a lever for change. “The aim is to give people the chance to make informed choices about the future—their fi nancial future and the world they want to live in,” says Vendette. “RI funds provide an opportunity to make a difference, by infl uencing the actual operations of the companies that are investment targets.”

This can happen in several ways. For instance, thematic investments select investment types or companies actively involved in confronting climate change or social issues. In some sectors, like energy, Desjardins invests in companies that set ambitious and achievable targets for energy transition and sustainable development.

Shareholder engagement uses levers like dialogue, right to vote, and shareholder proposals to incite companies to boost their ESG practices. (See “Change through shareholder activism.”)

“We believe we have more impact on businesses in this way than excluding them from our portfolios,” says Dion.

Once securities are held in a portfolio, Desjardins uses share ownership to encourage companies to improve their practices. These conversations, initiated by Desjardins portfolio managers, touch on all the ESG themes. By taking action, the companies involved also help to change the standards and practices of their entire sector.

“Companies that care as much about their environmental, social, and governance performance as they do about financial performance are better equipped to meet the challenges of the ever-changing global economy.”

Denis Dion, RI Funds Product Manager at Desjardins

Desjardins also collaborates with other institutional investors to discuss best practices and exert pressure for improving corporate policy, industry standards, and national or international regulations. For instance, Desjardins is a signatory to the Principles for Responsible Investment. This UN-supported initiative advocates for integrating ESG issues into investment practices.

It’s all part of upholding Desjardins Group’s commitments and

values, which advocate for economic development that’s respectful of people and the environment, where money is at the service of human development.

If RI is so appealing, why isn’t it even more popular?

In a Desjardins survey, 24%7 of respondents buy into the myth that returns on RI products are lower than on traditional investments. That’s just one of the many misconceptions about RI. Here are the facts.

Investors aren’t sacrificing potential returns for the greater good. RI generates returns that are just as good as—or, in some cases, better than—other funds in the same category. Observed strong returns debunk the performance myth.

RI is not just for idealists; it’s for investors aiming for returns based on their individual investment horizons and risk tolerances. They also have the option of integrating their support for sustainable development into their investment strategies.

All investors want to see their money grow, says Dion, including those who want more than just good financial performance from their investments. RI assesses financial performance and ESG—extra layers of analysis, which make for a solid risk management strategy.

RI also isn’t a publicity stunt or a passing fad. It’s widespread. Since 2006, more than 2,000 signatories around the world, representing more than US$83 trillion in assets under management, have come aboard the Principles for Responsible Investment8.

Choosing RI doesn’t leave people out of certain sectors, like energy or mining. RI doesn’t just invest in perfect companies; it invests in all kinds of sectors and pushes them further in ESG responsibility. Shareholders can encourage change from within. If you invest, you can influence.

Information and education are key to promoting RI, for advisors and clients alike. There’s a simple and powerful reason why businesses that engage in good ESG practices are smart investment choices.

“Companies that care as much about their environmental, social, and governance performance as they do about their financial performance,” says Dion, “are better equipped to meet the current and future challenges of the ever-changing global economy.”

Shareholder activism involves direct engagement with the companies in an investment portfolio whose reporting or environmental, social,

and governance (ESG) record gives cause for concern. This takes on three forms.

- Voting at annual general meetings (AGMs).

Any shareholder with $2,000 or more of company stock can file a resolution asking the company to improve its ESG practices. The investment fund can act alone or form coalitions with other national or international organizations. The possibility of a vote at an AGM can itself be a way to motivate companies to make improvements. Resolutions that go forward, and vote results, become public information; those are also tools to increase pressure on a company. - Opening a dialogue with businesses.

Sometimes, when voting doesn’t give the expected results, opening a dialogue can be used to influence companies. Shareholders can question company management or boards on any number of ESG issues, such as the safety measures they take when transporting oil and gas, the approach they take toward surrounding communities, or the view they take on gender-balanced boards. “Talking to companies may help them recognize that they need to make some positive changes. That can have a domino effect in compelling their competition to change, too,” says Denis Dion, RI Funds Product Manager at Desjardins. - Making shareholder proposals.

During company shareholder meetings, if the dialogue doesn’t work, investment funds can make their voices heard and make proposals at AGMs or vote on behalf of their shareholders on the proposals made by management and other investors. Desjardins Funds has voted in favour of proposals related to developing climate change strategies, for instance, and against director nominations that seem to undermine a board’s independence.

1 The responsible investing online survey was conducted on behalf of Desjardins Wealth Management and surveyed 2,212 Quebecers between Sept. 6 and 17, 2018. The margin of error was ±2.6%, 19 times out of 20

2 https://www.riacanada.ca/trendsreport/

3 Robert G. Eccles, Ioannis Ioannou, and George Serafeim, 2014. “The Impact of Corporate Sustainability on Organizational Processes and

Performance,” Management Science, Vol. 60(11), pages 2835—2857.

4 The Jantzi Social Index (JSI) was launched in January 2000 in partnership with Dow Jones Indexes. It is a socially screened, market capitalization-weighted common stock index modelled on the S&P/TSX 60 consisting of 50 Canadian companies that pass a broad set of ESG criteria. The JSI has begun to generate the first definitive data on the effects of social screening on financial performance in Canada.

5 Landmark study by Gunnar Friede, Timo Busch, and Alexander Bassen, published in the Journal of Sustainable Finance & Investment, 2015.

6 https://www.riacanada.ca/trendsreport/

7 The responsible investing online survey was conducted on behalf of Desjardins Wealth Management and surveyed 2,212 Quebecers between September 6 and 17, 2018. The margin of error was ±2.6%, 19 times out of 20.

8 https://www.unpri.org/pri/about-the-pri

9 https://blogues.desjardins.com/co-opme/2016/02/what-does-the-environmental-balance-sheet-of-an-investment-product-look-like.php

The Desjardins Funds are not guaranteed, their value fluctuates frequently and their past performance is not indicative of their future returns. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The Desjardins Funds are offered by registered dealers.