With markets at all-time highs, clients are looking for an alternative source of return and risk management. “Smart beta” has become a popular investing strategy to help achieve these client objectives.

What is smart beta? “It’s an index construction methodology that is different from a traditional market-capitalization weighting,” says McKenzie Box, Senior Product Manager at BMO Global Asset Management (BMO GAM). “It could include a strategy such as equal weighting, or more complex strategies focused on a specific market factor such as value, quality or income.” Smart beta has been used successfully by institutional investors for years. Now, through exchange-traded funds (ETFs), retail investors can efficiently access these institutional-like strategies to adjust their portfolios. Investors have embraced the emergence of smart beta, capitalizing on the opportunity to build portfolios based on isolated characteristics, to change the risk profile of a portfolio, or to complement an existing market-capitalization weighted ETF.

Smart beta allows clients to target specific factors

Institutions have been using smart beta solutions for some time, but now ETFs have made these strategies more accessible to both institutional and retail clients. Academic studies have shown that, historically, certain factors have consistently added value over the long term, especially on a risk-adjusted basis. Today, some of the most widely used factor-based ETFs in smart beta investing include:

- Value

Value investing is the pursuit of low-cost securities relative to their intrinsic value. At BMO GAM, factor-based value investing targets a concentrated segment of

an investable universe and identifies investment opportunities through evaluating metrics such as low price-to-book, and higher dividend yield metrics. - Quality

A quality investing strategy identifies companies with strong, long-term fundamentals. High-quality firms have competitive advantages and durable business models, so quality factors include high return on equity, stable year-over-year earnings growth and low financial leverage. Identifying these factors helps BMO GAM’s quality ETF strategy to avoid inexpensive stocks masquerading as bargains. - Low volatility

A low-volatility strategy aims to participate in market growth with potentially less risk. By selecting securities that exhibit lower risk relative to the broad market, a low-volatility strategy can soften the impact of market declines, helping the positive returns of a portfolio compound more effectively over the long run. - High dividend yield

High dividend investing identifies high-yielding, dividend-paying equities. BMO, for example, employs a custom strategy that screens for a dividends historical growth rate and long-term sustainability. This long- term strategy is a solution to address a client’s income gap and need for lower portfolio risk. - Size (equal weight)

Small-cap stocks tend to outperform large-cap stocks over the long term. Yet, conventional market-cap weighting strategies naturally assign a greater weighting to larger company stocks. An equal-weight methodology however, gives equal weighting to all stocks in a fund, regardless of market cap, allowing the portfolio to properly diversify sector exposures and to avoid individual security concentration.

It should be noted that factor-based investing can be used as core positions in your portfolio or can complement using tactical strategies. During certain points in the economic cycle, different factors may outperform others. Smart beta ETFs can deliver exposure to a desired factor and give an investor the ability to rotate into and out of these factor exposures efficiently to reflect market sentiment.

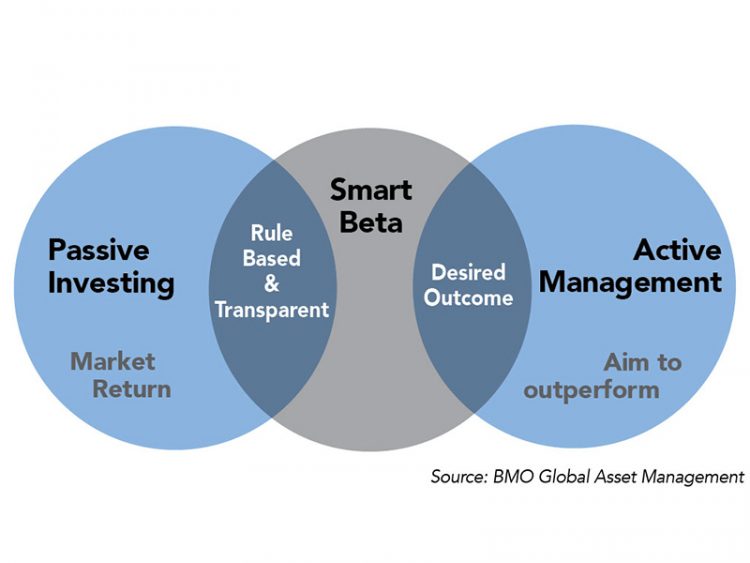

The best of active and passive investing

The evolution of the ETF industry has empowered investors with a new toolkit to implement these strategies efficiently and cost effectively. ETFs have moved beyond traditional exposures, giving clients more tools to build portfolios whether they are looking for higher yields, lower risk, or targeted factor exposures. In turn, smart beta solutions have given investors greater choice in terms of selecting a factor based on exposure and geography. Smart beta ETFs combine the best of active and passive investing, bridging the gap between the two worlds. Based on your clients’ objectives, you can help them tilt their portfolios in favour of specific factors. At the same time, clients can also enjoy the benefits of passive investing, including:

- Low cost

- Transparency

- Rules-based approach

To avoid biases, look under the hood

As smart beta has evolved, portfolios have moved beyond single factor lenses. Effective strategies are now increasingly screening for multiple factors and monitoring for unintended biases such as sector or industry concentration, or even excess turnover. Clients should always select an ETF provider with experience in product construction and risk management. Well-designed smart beta ETFs can help avoid unintended biases. “These biases are unwanted exposures that can become present when you’re isolating for a particular factor,” says Box.

Consider a smart beta ETF that uses dividend yield as the weighting metric. A stock whose dividend yield appears attractive because its share price has dropped significantly (for reasons like a negative earnings surprise, for example) would have a higher weight in the ETF. While the payout may not be sustainable, the stock is still included in the ETF because the selection rules failed to account for fundamental company changes.

Consider that same portfolio where a high concentration of financial stocks may pass the screens. BMO ETFs apply sector and security limits to ensure a well-diversified portfolio. After all, if clients want a bank or financial ETF those are available as well.

A well-constructed smart beta ETF has more than one defining metric and numerous built-in risk controls. For example, BMO Global Asset Management has created a custom solution to identify higher yielding dividend-paying equities, while screening for both the historical growth rate and sustainability of dividends.

One thing is clear: Smart beta is not a fad. “We’re seeing more multi-factor products come to market combining two different factors in one solution,” says Box. “We expect to see more innovative smart beta fixed income products come to market as well.” Overall, the future for smart beta strategies looks bright. Through the end of December 2017, global ETF assets in smart beta strategies totaled a record US$658 billion, and the five-year compounded annual growth rate stood at 32.2%.1

1 http://www.etfgi.com

BMO Global Asset Management is a brand name that comprises of BMO Asset Management Inc., BMO Investments Inc., BMO Asset Management Corp. and BMO’s specialized investment management firms.

BMO Mutual Funds refers to certain mutual funds and/or series of mutual funds offered by BMO Investments Inc., a financial services firm and separate legal entity from Bank of Montreal. BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and portfolio manager and separate legal entity from Bank of Montreal.

Commissions, management fees and expenses may be associated with investments in mutual funds and exchange traded funds (ETFs). Trailing commissions may be associated with investments in mutual funds. Please read the fund facts or prospectus before investing. The indicated rates of return includes changes in unit value and assumes reinvestment of all distributions, and does not take into account for account sales, redemptions, optional charges, or income taxes payable by any security holders, which would reduce returns. Mutual funds and ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

®”BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.