As part of the financial planning process, advisors are always looking for tax efficiencies to help clients keep more of their money. One attractive tax-advantaged insurance solution is the prescribed annuity, although advisors will need to act fast before this tax break is reduced.

Annuities purchased with non-registered money may qualify for prescribed taxation, which means a portion of the payment is return of capital and any taxable amount applies only to income payments. Unlike accrued tax treatment, where the taxable amount starts higher and reduces over time, the taxable amount under prescribed taxation is level for the whole term. With prescribed annuities, the policyholder must also be the annuitant.

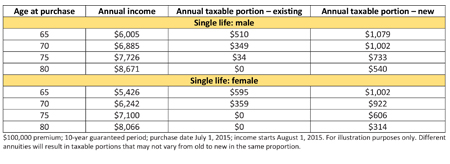

When income payments are made from a prescribed annuity, a formula is used to calculate the taxable amount. Typically, the older the policyholder is, the lower the taxable portion. In some cases, no tax is payable.

Changes to the federal Income Tax Act are on the way

Starting January 1, 2017, the taxable amount will change as the industry updates life expectancy tables used in the formula – which reflect that people are living longer – will replace the current tables using data from 1971, which will result in higher taxable amounts. Below are examples of how the taxable portion will increase.

Source: Sun Life Financial, Inc. 2016

Jennifer Poon, Director, Advanced Planning – Wealth at Sun Life Financial, says that “joint life annuities purchased with non-registered money also qualify for prescribed taxation, while term certain annuities may be eligible under specific circumstances, including if the term ends prior to the annuitant’s 90th birthday.”

Segregated fund contracts that provide for guaranteed income payments represent another way to draw tax-efficient income. If desired, redeeming segregated fund units is tax efficient because the redemption comprises part capital gain, part return of capital.

Initiate the conversation

Poon offers practical tips on how to approach the topic of insured products with older clients. “We believe it makes sense to talk about general financial planning aspects first, before drilling down to income needs and then specific solutions to help clients meet those needs.”

She says that once income requirements have been established in context of a client’s broader financial plan, advisors can determine how much income should be guaranteed to ensure that primary living expenses are covered. Clients who need income to be indexed (e.g., to inflation) should be informed that the indexing option nullifies any preferential tax treatment, as income from prescribed annuities must be paid in level (i.e., equal) payments.

The topic of income can seamlessly lead advisors to a discussion about suitable products, including life annuities. Since life annuities are non-commutable, non-transferable and offer no death benefit after the guarantee period, they might not be appropriate for people who want insurance products to fulfill their legacy wishes.

In such cases, segregated fund contracts may be a viable alternative since they offer a death benefit as well as liquidity, given that segregated fund contracts permit policyholders to redeem units at any time. If the client has no outstanding legacy or liquidity needs, then life annuities represent a cost-effective solution that offer potential creditor protection while also generating a tax-efficient retirement income stream.

Take action now!

Recently, Poon observed that there has been “considerable interest from advisors about the upcoming tax changes for prescribed annuities. These advisors want to understand the new tax rules and, equally important, they want to help clients take advantage of the grandfathering provision.” Life annuity policyholders whose income payments begin on or after January 1, 2017 can still use the old tables for tax calculations, provided that the contract was purchased by December 31, 2016 and all premium and payment amounts were set in the contract before 2017.

Clearly, now is an ideal time for advisors to review their book and determine which clients may benefit from prescribed annuities. Then they can move these clients into a contract before January 1, 2017, to enjoy significant tax advantages that will soon be reduced.