The challenges of today’s investment environment present a perfect storm of complexity – and stress – for retirees and pre-retirees.

Investor perceptions of how much they’ll need in retirement complicate the picture. According to research conducted by Natixis Global Asset Management, individuals in Canada say they will need 60% of their pre-retirement income to live comfortably in retirement.1 This is significantly less than the 75% to 80% traditionally recommended by financial professionals.

Conventional approaches

The conventional approach to asset allocation for investors nearing retirement is to gradually reduce the allocation to equities and other riskier assets, while increasing the allocation to fixed-income investments.

George Vazquez, Vice-President of Personal Retirement at Natixis Global Asset Management, says this may have been effective 15 or 20 years ago, when the 10-year Government of Canada bond, for example, offered a yield in the mid-to-high single digits. But today’s investor faces a very different environment, marked by two key challenges: 1) a new normal of anemic government bond yields, and 2) heightened equity market volatility, which can result in sudden, steep drawdowns. A major drawdown right when a retiree begins withdrawing funds – which magnifies the difficulty of recovering from the loss – is known as sequence-of-returns risk.

Common strategies for boosting income and returns in the face of these challenges include 1) using higher-yielding income sources (e.g., corporate bonds, dividend stocks), and 2) higher allocations to stocks for a longer period, paired with low-volatility strategies to help investors better withstand prolonged equity exposure.

A new approach

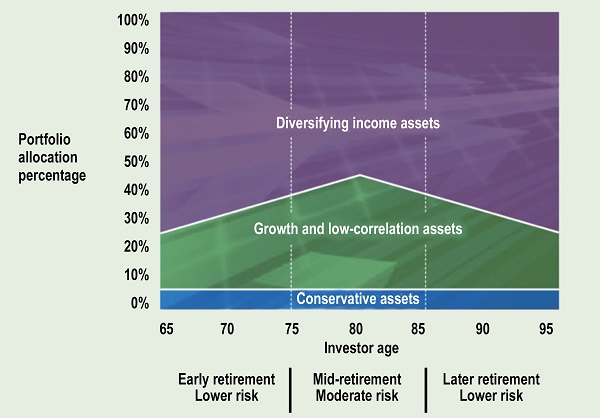

While these common strategies remain viable, Vazquez also suggests an alternative solution. The centrepiece is a retirement asset allocation that:

– keeps portfolio risk low in early retirement;

– increases the risk profile in mid-retirement; and

– reduces portfolio risk later in retirement.

The graph below illustrates how this approach could apply to a 30-year retirement period:

Vazquez says lowering portfolio risk early in retirement helps reduce sequence-of-returns risk. Gradually increasing the portfolio’s growth profile as mid-retirement approaches has two purposes. First, it adds to the asset base to account for the fact that life expectancies are higher today than they once were. This leads to the second component: the longer you live, the more exposed you are to inflation risk. Boosting portfolio growth enables the investor to maintain the purchasing power of his or her retirement assets for a longer period of time.

In the final stage of retirement, investors are more likely to have out-of-pocket healthcare needs; they may also have plans to transition assets to the next generation. This puts a premium on capital preservation, and for this reason the portfolio’s risk profile should be lowered.

Assets of choice

Vazquez offers guidance on choosing investment vehicles for each of the three categories depicted in the chart above, i.e., 1) diversifying income assets, 2) growth and low-correlation assets, and 3) conservative assets.

In the first category, he suggests government and agency bonds, floating-rate and inflation-protected securities, and investment-grade credit. “You want a diversified pool of income-generating assets that are not focused on any particular sector of the market,” explains Vazquez.

For the second category, consider actively managed mutual funds that use both value and growth strategies. Also consider alternative investments for their capital growth potential and low correlations to equities and bonds.

The third category is the cash allocation (typically 4% or 5%); it holds roughly a year’s worth of income, which the investor draws from to meet spending needs in retirement.

Embracing change

Change is never easy, but as the investment environment undergoes long-term tectonic shifts, advisors must be prepared to think outside the box to help clients meet their retirement goals. Considering new ways of approaching asset allocation is one important step they can take to adapt to the new reality.

To learn more about the innovative Natixis approach to retirement asset allocation, and the solutions that can help implement it, visit durableportfolios.com.

1Natixis Global Asset Management, Global Survey of Individual Investors conducted by CoreData Research, February–March 2016. Survey included 7,100 investors from 22 countries, 300 of whom are Canadian investors.

Partner Reports is a space made available for businesses who wish to publish content for the financial professionals. Investment Executive journalists are not involved in writing these articles.