Exchanges and alternative trading systems are essential links in the distribution chain for ETFs in Canada. Understanding their complex infrastructure helps financial advisors serve clients better.

Stock exchanges are a “vital component” of the asset-management ecosystem, says Daniel Straus, vice president, ETF and financial products research, with Montreal-based National Bank of Canada. ETF portfolio managers rely on “a smooth, liquid and well-led” exchange to manage their portfolios on behalf of unitholders.

Canada has 13 markets through which securities listed on the Toronto Stock Exchange (TSX), NEO Exchange (NEO), TSX Venture Exchange or Canadian Securities Exchange (CSE) are traded.

These markets can be divided into two groups: exchanges and alternative trading systems (ATS). The exchanges review and approve the listing of ETFs, public companies and closed-end investment funds, each of which are subject to various rules.

“When ETF manufacturers want to launch a product, they have to have it approved by the exchange’s regulatory team because exchanges are always responsible for reviewing any listed instrument,” says Jos Schmitt, president and CEO of NEO Exchange Inc., which is owned by Toronto-based Aequitas Innovations Inc.

As of June 30, the TSX listed 766 Canadian ETFs; NEO had 46 listed ETFs as of Aug. 24.

Kevin Prins, managing director and head of ETFs and managed accounts with Toronto-based BMO Global Asset Management, says choosing one exchange over the other is getting harder as each improves its service.

“To [choose an exchange], we look at several things, including the quality and dissemination of information and the feedback we receive from our constituents,” Prins says.

ATS — which include Omega ATS Inc. (operated by Toronto-based Tradelogiq Markets Inc.; Matchpoint Financial Corp. owns the controlling interest), TSX Alpha and Chi-X Canada (the latter is owned by New York-based Chi-X Global Holdings LLC) — don’t list ETFs, but they can trade most of those products on their platforms.

ATS increase competition and play “an important role in pubic markets by allowing alternative means of accessing liquidity, with each venue providing differentiated trading services/fees to the market,” according to a BMO report from earlier this year.

Exchanges and ATS use different technology to place buy-and-sell orders, and attract different types of investors and traders by differentiating their trading offering, the BMO report states.

Maintaining the infrastructure to swiftly handle high volumes of orders from market makers can be a challenge, as was the case in March, when markets were volatile.

“Around March 17, the number of orders was 10 times the usual volume,” says Schmitt. “Volatility was so high that market makers were constantly adjusting their bids. [Everyone’s] infrastructure was put under extreme pressure.”

NEO used the March 21–22 weekend, when markets were closed, to increase platform capacity with upgrades to its computer centres, Schmitt says.

Exchanges and ATS also compete on pricing and the services they offer dealers to attract a share of trading volume.

Competition creates downward pressure on the fees that trading platforms charge, Straus says: “Running a stock exchange, from one angle, appears to be a commodified service; from another angle, it’s extremely complex, sophisticated and technically demanding with a lot of investment and technology required.”

The TSX was the first exchange to list an ETF 30 years ago. “We have a long history of listing ETFs, so the vast majority of Canadian ETFs are found on our marketplace,” says Graham MacKenzie, head of ETFs and structured notes with TMX Group Ltd. “People are confident that funds will be available and visible.”

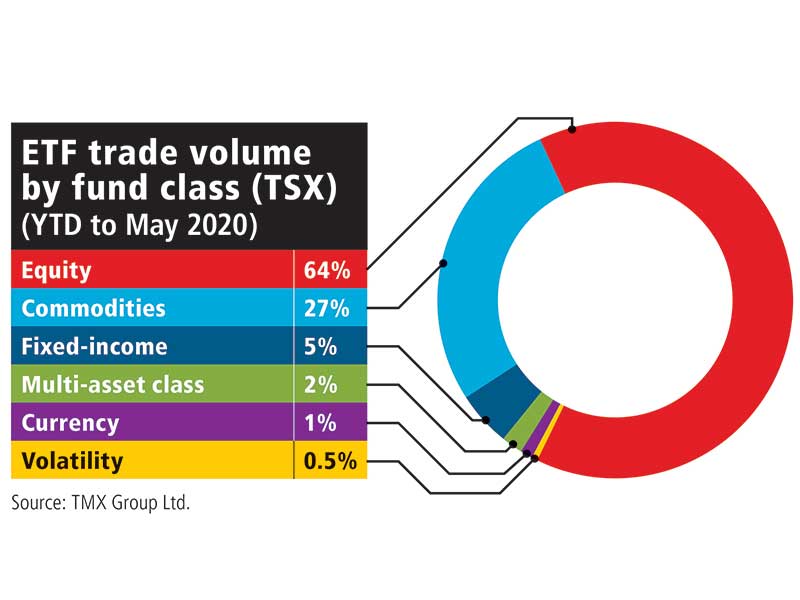

ETFs listed on the TSX may also trade on other exchanges and ATS, and the majority of ETF volume is currently traded on non-TSX platforms.

As of May, according to NEO, 42% of Canadian ETF volume was traded on a TMX-owned platform, compared with 35% on a NASDAQ-owned platform, 18% on a NEO platform, 3% on an Omega platform and 1% on the CSE. (Numbers do not add up to 100% due to rounding.)

This fragmentation of ETF trading volume, when added to fragmented information, can result in some advisors and investors making decisions based on incomplete data.

ETFs listed on NEO trade only on NEO platforms. This is a big advantage, Schmitt says, because it “solves the problem of unconsolidated market data, and the fragmentation of an ETF’s trading activity can be used to take advantage of long-term investors.”

According to Schmitt, high-frequency traders can exploit a price differential when the same ETF is traded in different markets or take advantage of a market maker who doesn’t have the same technology to gather data.

For instance, a trader who knows that the price of gold has changed in New York can take advantage of a temporary price inefficiency for an ETF tracking a gold index to generate profit.

NEO aims to restore a fair balance between these traders and long-term investors by imposing a delay between the receipt of an order and its execution, particularly for high-frequency traders. “Market makers are much more comfortable placing orders because they know they have time to protect themselves if there’s a market movement,” Schmitt says.

The Investment Industry Regulatory Organization of Canada (IIROC) notes that other trading platforms also offer some form of imposed delay.

Market makers play a vital role

Market makers, who often work at broker-dealers or brokerage firms, play a crucial role in the process of creating and redeeming ETF units and, more important, in determining unit pricing.

ETFs are made up of a basket of underlying securities. The value of this basket fluctuates, which influences the ETF’s price. For a market maker to provide continuous bid or ask quoting, pricing has to be based on the value of the underlying assets plus fees, such as costs related to the purchase or sale of the basket of underlying securities, stock exchange fees and the cost of foreign currency transactions.

Prices posted on electronic platforms may come from retail orders, but not usually. “For nearly every ETF trade that happens, one side is the investor and the other side is the market maker,” says Patrick McEntyre, managing director, electronic trading, with National Bank Financial Ltd.

The market maker relies on the exchanges to provide technology that can accept order messages quickly and process a lot of information and traffic, McEntyre says.

“The investor should not shy away from a product based on how frequently something trades,” says MacKenzie. “They should feel confident that a market maker is there to facilitate liquidity, and [that] this liquidity is based on the underlying investment of that product.”

Ensuring best execution

Advisors often are unaware of the market their ETF will trade in. This decision is up to their dealer, which is required to provide best execution.

Under IIROC Dealer Member Rule 3300, dealers must consider the price, the speed of execution, the certainty of execution and the cost of the transaction.

“For each of these factors, advisors have to know how the dealer executing the trade will handle their order to ensure best execution,” states an email from IIROC. “While advisors don’t necessarily need to know all the mechanics of the marketplace, they need sufficient understanding of the marketplace to be able to enter orders in an informed manner, give appropriate instructions regarding orders and understand how the dealer will execute those instructions.”

MacKenzie says the advisor should have “the utmost confidence” in the routing decision made by the broker-dealer.

“There are policies put in place, and those are constantly reviewed by the broker-dealer to ensure that the best trading practices are in place so the client gets the best price and the ability to get orders completely filled,” MacKenzie says.

While the Canadian Securities Administrators, not IIROC, monitors the activities of exchanges and ATS, IIROC regulates their ETF and equities trading activity. In particular, IIROC administers the Universal Market Integrity Rules and monitors the procedures of trading desks and individuals with market access. Thus, IIROC reviews trades after execution to detect any violations of trading rules and may conduct preliminary investigations.

Trading ETF options

Some advisors and investors buy or sell options on certain ETFs through the Montreal Exchange, which specializes in derivatives.

In July, the number of ETFs and indexes comprising the underlying securities for call or put options was limited to approximately 50. During the first quarter of 2020, volume was concentrated in the following ETF manufacturers: BlackRock Inc. (73.9%), BMO Global Asset Management (20.5%), Horizons ETFs Management (Canada) Inc. (5.6%) and Vanguard Group Inc. (0.03%).

During this period, iShares S&P/TSX 60 Index ETF had the highest volume of options, followed by BMO Equal Weight Banks Index ETF, BMO S&P 500 Index ETF and Horizons Marijuana Life Sciences Index ETF.

“Some investment advisors invest in a security or ETF that is optionable. They think it’s an extra layer of liquidity,” says Alain Desbiens, director, BMO ETFs, Quebec and Atlantic region, with BMO Global Asset Management.

ETFs with options listed to trade are more attractive to some investors, says Catherine Kee, senior manager, corporate communications and media relations, with TMX Group Inc. The hedging activity of the option market maker should increase the trading, she says.

“It’s important to remember that the amount an ETF trades does not necessarily mean an ETF is more or less liquid,” Kee says. “The liquidity of an ETF is based on the liquidity of its underlying assets.”

ETFs traded on the NEO Exchange are not optionable under a Montreal Exchange-listed derivative, Kee adds.

Jos Schmitt, president and CEO of NEO Exchange Inc., says this hasn’t been a major issue to date. If options eventually impact NEO’s ability to list an ETF, he says, he will push to allow for options trading on NEO-listed ETFs through Montreal Exchange-listed derivatives.