The fast-evolving retail investment market poses a constant competitive challenge for investment firms. For regulators, the mission is to stay relevant. With that in mind, the Mutual Fund Dealers Association of Canada (MFDA) is launching a new strategic plan designed to carry the self-regulatory organization (SRO) into 2017.

“Technological innovation, increased cost pressures, a mature market and an aging population are all factors that will impact [fund dealer] operations in years to come,” the MFDA notes in its plan, which was formally introduced as Investment Executive went to press.

The SRO indicates that fund industry growth rates probably will decline in the years ahead as baby boomers retire and shift their portfolios into the deaccumulation phase. And the MFDA expects the population of qualified financial advisors to shrink, too, as veteran reps retire.

With these shifts on the horizon, enhancing proficiency is a key focus of the MFDA’s new plan, and the SRO has several initiatives in the works. For one, the MFDA plans to introduce new continuing education (CE) requirements for fund dealer reps.

The MFDA aims to release a discussion paper by the end of June outlining the SRO’s vision for new CE requirements, says Karen McGuinness, the MFDA’s senior vice president, member regulation and compliance. That paper will canvass industry and investor opinions on the MFDA’s approach to mandating CE for fund reps, which the SRO will use to develop the form and content of the requirements. Then, the usual rule-making process, involving further public comment will kick in and, ultimately, approval from the provincial regulators will be sought.

In the meantime, the MFDA plans to publish a new rule that will establish a proficiency requirement for reps that deal in exchange-traded funds (ETFs). Although fund dealers have long had this capability in theory, only in the past year or so has the industry developed the infrastructure to allow reps to trade in ETFs.

Now, the MFDA wants to introduce a rule to ensure that reps who plan to trade in ETFs have the necessary training, education and experience. Again, McGuinness says, the proposed rule and a complementary notice on ETF proficiency are likely to be published by the end of June.

In addition, with the Ontario government having initiated consultations on the possible regulation of financial planners (taking into account increasing concern of both investor advocates and regulators regarding dealer reps’ use of titles and credentials), the MFDA plans to issue a discussion paper this summer to solicit input on proficiency standards for reps who call themselves “financial planners.”

These forthcoming proficiency initiatives come in the context of an evolving retail investment environment, which is both increasingly competitive and evermore closely scrutinized by regulators. These trends put the MFDA’s primary constituency – mutual fund dealers – under pressure.

Although mutual funds remain the dominant investment product for the bulk of Canadian investors, those products face increasing competition from ETFs as investors become more cost-conscious in a persistently low-return environment.

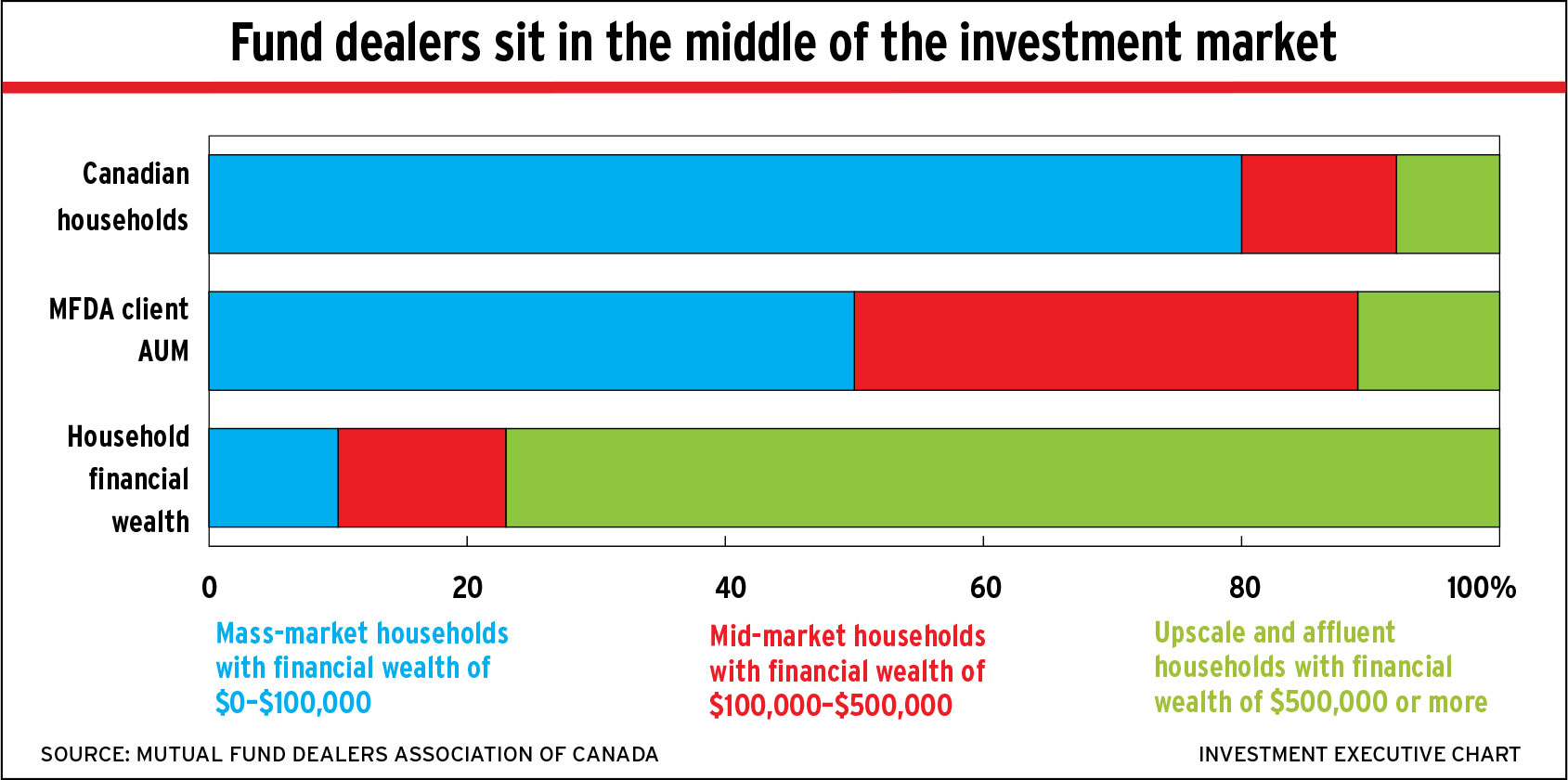

The fund dealers are also being squeezed between investment dealers competing for the dealers’ higher-end clients and intensifying competition for dealers’ traditional mass-market clients. Robo-advisors have emerged as a new threat in the mass market, in which banks are powerful competitors. And exempt-market dealers are rising contenders for investor dollars, too.

Provincial regulators appear to be increasingly sensitive to retail investors’ issues. Regulators’ ongoing deliberations about introducing a fiduciary duty for advisors and possibly banning trailer commissions, along with the implementation of reforms that aim to improve industry disclosure and transparency drastically, signal regulators’ interest in ensuring that investors are getting a fair shake and value for their money from the investment industry.

One way for fund dealers to compete, and to meet regulatory expectations, is through enhanced proficiency. And although the MFDA appears to be trying to drive improvements in these areas over the next couple of years, the SRO hopes to enhance investor proficiency, too.

The MFDA’s new strategic plan also indicates that the SRO will develop new materials that target investors directly in an effort to help them better understand the industry’s products, the advisory process and investment metrics such as performance and cost. The MFDA has started to do some of this, but plans to expand those efforts to include topics such as the second phase of the client relationship model (a.k.a. CRM2) and Fund Facts.

On the investor protection front, one of the topics singled out by the MFDA in its new plan is handling complaints. The SRO pledges to step up its efforts to ensure that fund dealers have adequate processes in place to resolve client complaints quickly and fairly.

McGuinness says these efforts could include providing additional guidance to the industry overall, engaging with firms individually or using other methods, such as webcasts, to encourage best practices for handling complaints throughout the mutual fund industry. However, the MFDA isn’t contemplating new rules in this area.

The MFDA also intends to provide the industry with data, both on the investment market overall and on fund dealers specifically. The goal, McGuinness says, is to give all firms “information on market trends, and allow them to benchmark their operations to the rest of the [industry].”

© 2015 Investment Executive. All rights reserved.