While two-thirds of advisors surveyed last year were bullish on their expected outlook for the S&P/TSX 60 index, only a minority remain bullish for the first three months of 2022, a survey from Horizons ETFs Management (Canada) Inc. suggests.

“Both Canadian investors and advisors have shifted overwhelmingly toward bearish sentiment across most market indices and asset classes,” Horizons said Wednesday in a release with results of its advisor and investor sentiment surveys for the first quarter of 2022.

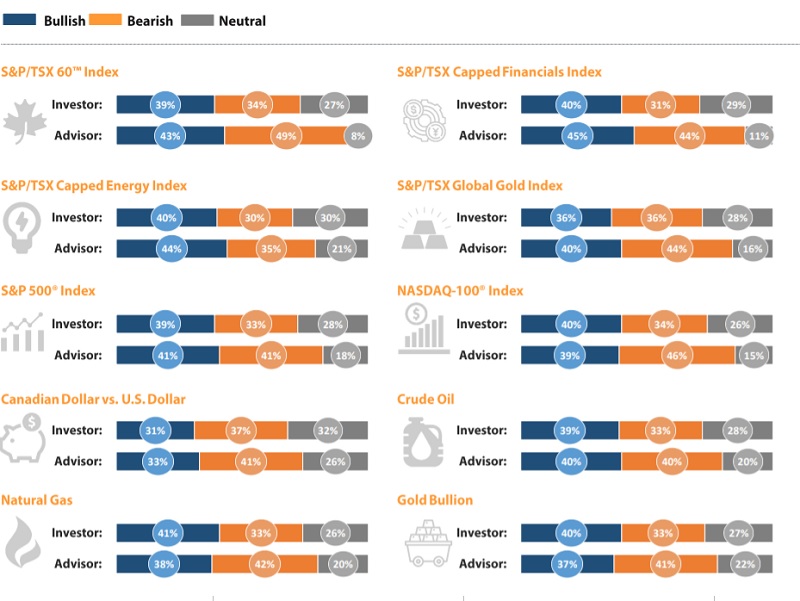

For the S&P/TSX 60, 43% of advisors were bullish in their outlook for the first quarter, down from 69% in Q4 2021. Even fewer investors (39%) were bullish about the Canadian index, down from 50% last quarter.

For the S&P/TSX Capped Financials Index, 45% of advisor respondents were bullish, down from 53%. Almost just as many (44%) were bearish about financials, up from 29% in Q4 2021.

About a third of investors (31% in Q1 2022 and 32% in Q4 2021) remained bearish on financials while the percentage of investor respondents who were bullish dropped to 40% from 46%.

“Once again, investors and advisors both decreased their bullish sentiment on the performance potential of Canadian banks in the new year,” Horizons said Wednesday.

For the S&P 500, 41% of advisors were bullish in their expected outlook for Q1 2022, down from 53% in Q4 2021. The same number of advisors (41%) were bearish about the U.S. index, up from 31% in Q4 2021.

Fewer than half (43%) of advisor respondents remained bullish on their expected outlook for the Bitcoin price in Q1 2022, down from 53% in Q4 2021. Meanwhile, 38% of investors were bullish on Bitcoin, down from 52%.

About a third (36%) of advisor respondents remained bullish on the North American Marijuana Index, unchanged from Q4 2021. However there were considerably more (44%) advisor respondents who reported feeling bearish about the marijuana index.

“There has been a remarkable reversal of sentiment on the Canadian outlook heading into 2022,” said Mark Noble, executive vice-president of ETF Strategy at Horizons ETFs, in the release.

“With the arrival of the Omicron Covid-19 variant in Canada and subsequent lockdowns underway across the country, investors and advisors may be bracing for more economic pain through the quarter ahead.”

For Q1 2022, Horizons had 965 respondents to its investor survey and 232 respondents to its advisor survey, both of which were conducted by SurveyMonkey. Online surveys cannot be assigned a margin of error because they do not randomly sample the population. The surveys ask respondents if they’re bullish, bearish and neutral about several asset classes.