Rising stock markets are boosting investor confidence and leading Canadians to increase the share of income they invest, according to the latest TD Investor Insights Index.

The annual survey found that more than half of Canadian investors saw their investments improve over the past 12 months and nearly as many expect continued gains in the year ahead.

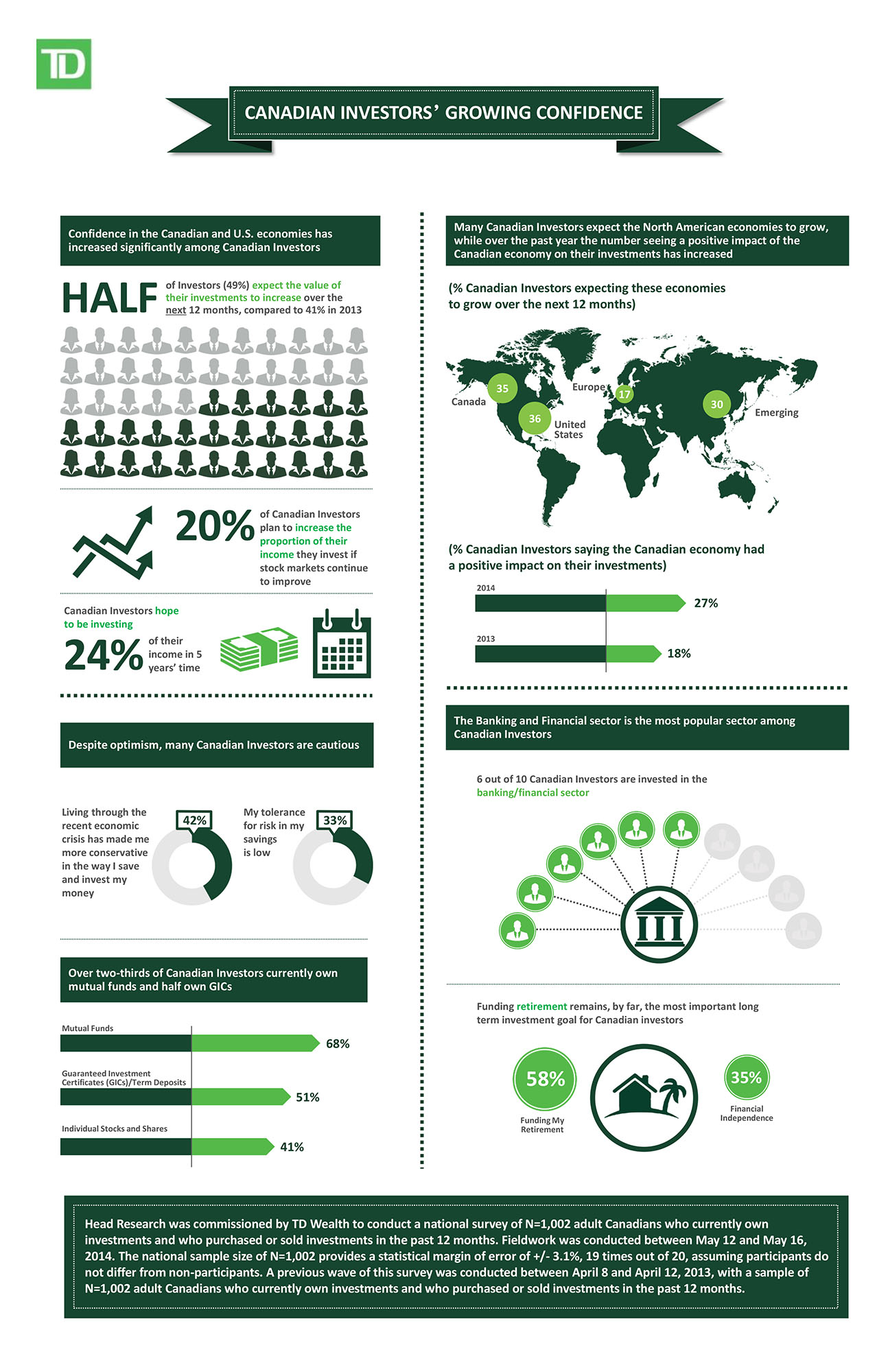

As a result, Canadian investors now invest 14 per cent of their income, up from 12.6 per cent in 2013, with one in five investors planning to increase the proportion of income they invest if stock markets continue to improve.

“Canadian investors have acted on the positive view of market conditions in Canada and the United States that they expressed a year ago by boosting the amount of money they invest in a small but significant way,” says Bob Gorman, chief portfolio strategist at TD Wealth. “With many investors expressing similarly positive views this year, we could see even higher levels of investment going forward.”

The TD Investor Insights Index found that more than a third of Canadian investors expect the Canadian and U.S. economies to improve over the next 12 months, up from about a quarter who expected improvements in 2013. Gorman notes that this rising confidence is helping investors get closer to their ideal goal of investing about a quarter of their income each year to meet their long-term financial goals.

“With stock markets hitting record highs recently, it’s understandable why investors are in a buoyant mood and looking to invest a bigger share of their income,” says Gorman. “But even if markets slip back somewhat, there are great opportunities for investors to continue to earn solid returns if they choose a balanced portfolio that offers the prospect of growth while respecting their individual tolerance for risk.”

Many Canadian investors say that, despite rising stock markets, living through the recent economic crisis has made them more cautious investors, with one-third describing their risk tolerance as low, a figure that hasn’t changed since the 2013 survey. For investors getting close to retirement age, the proportion with a low risk tolerance jumps to 41 per cent.

Mutual funds continue to be the most popular type of investment in Canada, held by more than two-thirds of investors, followed by GICs/Term Deposits and individual stocks and shares. Real estate also remains a popular investment, with nearly four out of 10 investors who say it will always be beneficial.

The survey identified funding retirement and achieving financial independence as the most important long-term investment goals for Canadians, a continuing trend from the 2013 survey. Funding retirement is also the top short-term goal, but travel comes second, followed closely by financial independence and paying off debt. Buying a house is the short-term and long-term goal for about one in 10 Canadian investors.

But the survey also found that, despite having these goals, nearly a third of Canadian investors do not follow an investment strategy or rarely follow one, and that only one in five have a strategy and stick to it each time they make an investment decision. It also found that almost half of Canadian investors struggle to understand the different investments that are available today and aren’t sure where to go to get trustworthy advice.

“It can be difficult to develop an investment plan to achieve your short and long-term goals, particularly with so many investment options to choose from,” said Gorman. “That’s why an increasing number of investors are turning to financial advisors to learn about their options and create an investment plan that meets their needs.”

The survey was conducted on behalf of TD Wealth by Head Research. The national online survey of 1,002 respondents among Canadian investors who purchased or sold investments in the past 12 months and who currently hold at least one investment product was conducted between May 12 and May 16, 2014, with a statistical margin of error of plus or minus 3.1 per cent, 19 times out of 20.