Year after year, the financial advisors surveyed for Investment Executive‘s Dealers’ Report Card say there’s one category that firms can never quite get right: “technology tools and advisor desktop.” This consists of the software at the centre of advisors’ daily workflow, such as their customer relationship management (CRM) system. And, to no surprise, advisors were no less frustrated than usual this year.

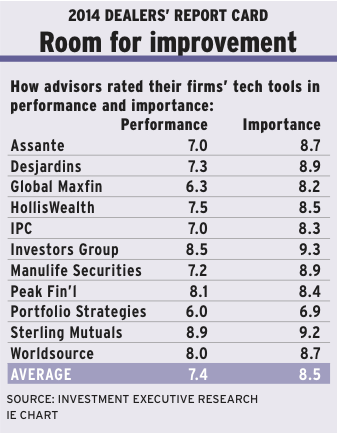

Case in point, the satisfaction gap, which is the difference between the overall average performance rating (7.4) and the overall average importance rating (8.5) that advisors give to a category, is tied for second-largest in the survey, behind only “back office and administrative support.”

That the tech category has one of the largest satisfaction gaps is nothing new; tech tools have consistently registered among the largest satisfaction gaps in the Report Card year in and year out. Not surprising, advisors cite many of the same reasons for their dissatisfaction every year: their technology is outdated or obsolete, complicated and cumbersome, among other things.

And with today’s technological landscape in constant flux, firms are perpetually struggling to find the balance between keeping up with changing times and disrupting advisors as they learn about – and work out the kinks in – their new software. The most common objective shared by firms upgrading their technology is to integrate systems and work toward a single or simplified platform.

For example, in the past year, Assante Wealth Management (Canada) Ltd. and HollisWealth Inc., both based in Toronto, rolled out new initiatives to integrate their front-office CRM software with their back-office platform.

Although Assante advisors gave their firm a modest performance rating of 7.0 in the category, that dealer saw the biggest year-over-year gain in the Report Card, as its rating rose from 5.7 in 2013.

An Assante advisor in Ontario was not alone in saying that the dealer’s tech offerings still had room for improvement, but nonetheless was pleased the firm had made the update of its technology a priority over the past while: “I’ll give them credit for trying. Until recently, there was no head office-generated support in the CRM.”

For some Assante advisors, the initiative stood out because of the firm’s effort to mitigate the disruption with one-on-one training sessions for advisors – although mastering the new system will take some time.

“We have a new system and we aren’t as efficient with it yet,” says an Assante advisor in British Columbia. “The transition hasn’t been pretty. I don’t think they could possibly provide enough support for us to get all the way up to speed with the new system right away. But I think this program will be much more effective and powerful once we master it.”

“It takes more time for us to do [it this way], but it is far more effective,” says Robert Dorrell, Assante’s senior vice president of distribution services, “[because] everybody learns at a different pace and advisors use technology to different extents.”

As for HollisWealth, it saw its average performance rating fall to 7.5 from 8.1 year-over-year. Tuula Jalasjaa, managing director and head of the firm’s retail advisory network, says the firm’s advisors may have struggled with upgrades this year because this included the rollout of a new email system, which was mandatory for security reasons.

“I think there’s a lot of frustration when someone tells you to change your email system,” Jalasjaa says. “We needed to do that for the security of our advisors and clients. A number of advisors now see the advantages and the things it’s catching.”

As a matter of fact, several HollisWealth advisors spoke positively about the new technology tools at their disposal. A HollisWealth advisor in Atlantic Canada, for example, saw a big improvement in the firm’s new software: “To prepare a report for three clients [previously] took my associates the full morning. Now, it takes them eight minutes.”

Adds a colleague in Ontario: “It’s a major improvement having everything online. All the client information is integrated.”

These efforts – similar to ones implemented in recent years by Mississauga, Ont.-based Investment Planning Counsel Inc. (IPC), Markham, Ont.-based Worldsource Wealth Management Inc. and Winnipeg-based Investors Group Inc., for example – appear to respond to the most common technology complaints among advisors: that their firms’ systems are out of date and not user-friendly.

“[The firm’s software is] so old and difficult,” says an advisor in Ontario with Richmond Hill, Ont.-based Global Maxfin Investments Inc., “that getting reports is very tedious.”

And firms that have upgraded their systems are not immune from this sentiment, either. For example, a HollisWealth advisor in Ontario, like many advisors throughout the survey, struggles with the complexity of the firm’s software: “It’s like a fellow with a private flying licence sitting in the cockpit of a 747.”

Other advisors point to software that’s not user-friendly – and they dislike dealing with a medley of unrelated software applications.

“I’d like it if everything worked together better,” says an IPC advisor in Ontario. “They’re all stand-alone platforms right now. I’d like it if they had just one data-entry point.”

Windsor, Ont.-based Sterling Mutuals Inc. stands out, not only because of the strength of its software, with which its advisors are thrilled, but because the dealer developed the platform in-house. As a result, the firm’s advisors gave their tech tools the highest performance rating in the category, at 8.9.

OneBoss is the name of Sterling Mutuals’ platform. It integrates the front- and back-office systems into a single, customizable desktop. The platform includes alerts for client birthdays and expiring “know your client” forms, maps to client residences, a data-entry wizard to guide the account-opening process and reduce duplication, and an engine for creating customized client reports.

“That’s why I’m here,” says a Sterling Mutuals advisor in Alberta about OneBoss. “It’s one of the few firms with integration between CRM and the back office, and one of the better programs out there.”

Adds a colleague in Ontario: “They were very proactive in telling people to use it and to provide feedback during its development. It’s a reason it’s as good as it is.”

OneBoss is the brainchild of Sterling Mutuals CEO Nelson Cheng, who went from writing some of the early code himself to having six programmers on staff.

“It gives us the flexibility to provide our advisors with what we need as a firm,” says Cheng, “instead of shaping your processes to meet someone else’s software.”

© 2014 Investment Executive. All rights reserved.