The flow of assets into exchange-traded funds (ETFs) is swelling to a torrent.

The easy access that ETFs allow to diversified investments is finding favour with investors ranging from institutional pools to tech-savvy young people. And in today’s volatile financial markets, ETFs’ low cost is particularly appealing – your clients may not be able to reap the healthy gains of past years, but the corrosive effects of fees are reduced, at least.

The healthy appetite among investors for ETFs is giving rise to a profusion of product choices, as well as the emergence of new and innovative providers. Traditional mutual fund companies and the big banks also are getting in on the action.

“ETFs are a more efficient delivery mechanism for many different investment strategies,” says Steven Hawkins, co-CEO and chief investment officer with Horizons ETFs Management (Canada) Inc. in Toronto. He likens ETFs to the “iPod of the investment industry” – an evolutionary leap beyond mutual funds, the less sleek Sony Walkman of the industry.

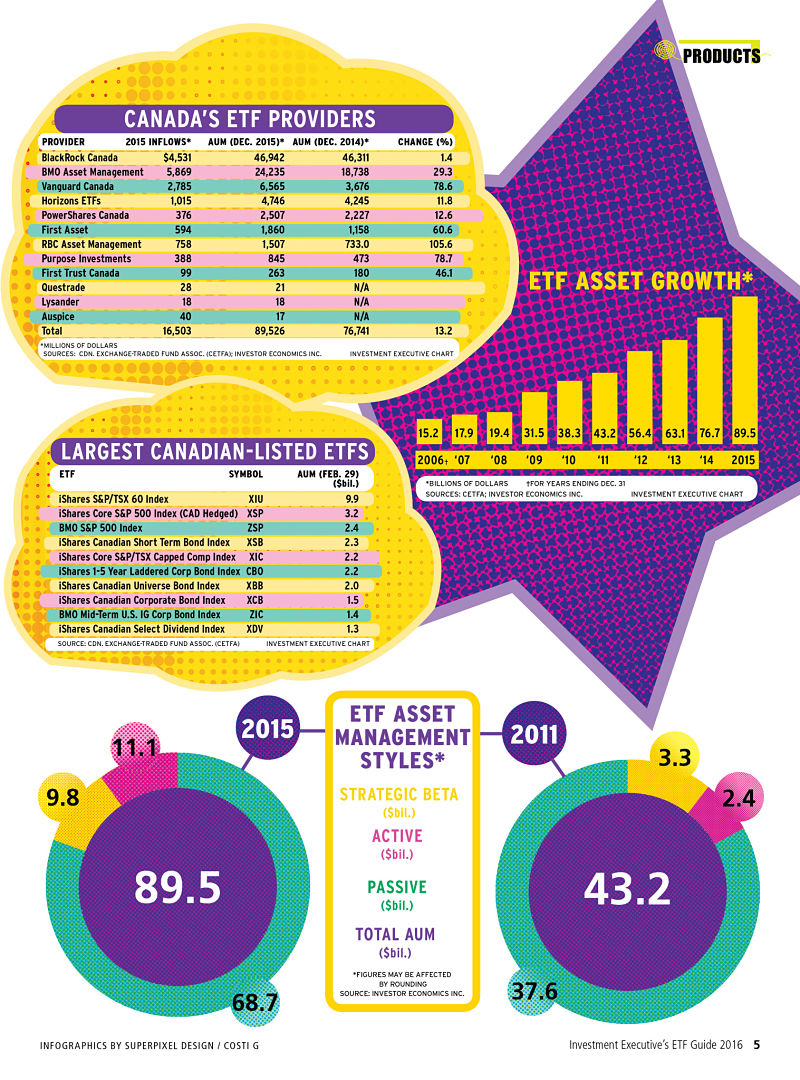

As of Dec. 31, 2015, there was $89.5 billion in assets under management (AUM) held in Canadian ETFs spread among 373 funds, according to the Canadian Exchange-Traded Fund Association, representing growth of almost 17% year-over-year in turbulent times; 2015 saw record-breaking net inflows of $16.5 billion, surpassing the previous record of $11.8 billion set in 2012. Sixty-three per cent of ETFs was held in retail clients’ hands, while 47% was held by institutions.

In comparison, the venerable Canadian mutual fund industry saw net sales of $57.5 billion in 2015, more than triple the flow into ETFs, with mutual fund AUM increasing by 8% year-over-year to $1.2 trillion, according to figures provided by Toronto-based Investor Economics Inc.

In the U.S. market, flows into ETFs are dwarfing sluggish mutual fund sales, suggesting that there is ample room for Canada to catch up if the same trend takes hold here.

“I expect ETFs to be 50% of the Canadian investment funds market within a decade,” says Scott Boniferro, vice president of global investment strategies for PowerShares Canada, a division of Invesco Canada Ltd of Toronto, a provider of both ETFs and mutual funds. “[ETFs are] an inexpensive vehicle that can be used for lots of different strategies, including low volatility, bond laddering and high yield. And, as [ETFs] evolve, they are creating new and innovative ways to approach the market.”

Increasingly, ETFs are being used by investors to move beyond Canada and into international and emerging markets in both fixed-income and equities. Currency-hedged versions of these ETFs allow investors to eliminate the influence of exchange rate movements on portfolio returns.

In addition, as ETF product providers look for ways to gain market share, a growing selection of ETFs are offering exposure to variations on traditional stock and bond indices. These products include automated, rules-based ETF portfolios based on a customized set of investment criteria known as “strategic beta” or “smart beta.” The ETFs in these segments of the market differentiate themselves in a variety of ways, including emphasizing dividends, low volatility, fundamental investment characteristics or a mix of customized securities-selection criteria. As well, there has been an influx of actively managed ETFs with underlying portfolios built by portfolio managers using subjective decision-making skills.

The evolution beyond the basic, market capitalization-matching of indices that characterized the first generation of ETFs is adding new layers of complexity and opacity, as well as increasing portfolio-management costs beyond the rock-bottom levels of passive index-tracking ETFs. In addition, as ETFs move beyond passive portfolio-management strategies, understanding exactly what kind of exposure is offered, as well as the liquidity issues and the underlying risks, becomes increasingly challenging for financial advisors and their clients. This complexity can make creating properly balanced portfolios with optimal correlation of asset classes difficult.

“It’s a growing industry and is attracting people who want to build something new, but I worry a little about some of the things [being] wrapped up in the ETF structure,” says Warren Collier, managing director of iShares Canada with Toronto-based BlackRock Asset Management Canada Ltd. “Some strategies are complicated; they go against the assumption that ETFs are always efficient and transparent.”

The hunger for ETFs is being stimulated by regulatory initiatives such as the second phase of the client relationship model, which will require advisors to disclose fees and costs to clients as of July. Some clients will realize for the first time how much they are paying for financial advice.

To remain competitive, more advisors are converting to a fee-based compensation model. Many are looking at low-cost ETFs to form the building blocks in clients’ portfolios, both for core asset exposure as well as for specific niches in sectors or geographical regions.

The explosive arrival of robo-advisors on the scene also has fuelled demand for ETFs, which conveniently can fulfil the basic asset-allocation strategies offered by robos.

The most popular ETF asset class remains equities, accounting for 67% of inflows in 2015. By Dec. 31, 2015, AUM in equities-based ETFs was $59.4 billion, roughly two-thirds of the $89.5 billion AUM held in Canadian ETFs, and well ahead of the $27.6 billion in AUM held in fixed-income ETFs. The AUM held in other categories, including ETFs based on commodities, currency, volatility and multi-asset classes, was considerably smaller.

On the fixed-income side, ETF investors have a plethora of choices, including government, corporate and high-yield bonds; laddered bond portfolios; and floating-rate loans; as well as convertible bonds, municipal bonds, global and emerging markets bonds; and preferred shares. Given the low interest rate environment (in which the impact of portfolio-management fees is magnified), the low management expense ratios of ETFs are particularly important for fixed-income investors.

“The expanding choice of fixed-income ETFs allows investors to target specific areas and position exposure along the yield curve or credit spectrum,” says Mark Raes, vice president and head of product at Toronto-based BMO Investments Inc. “[Portfolio managers] can choose to invest in corporate or government bonds, or to go short- or long-term. It’s a move beyond the older model of simple asset allocation. Investors now can target more specifically both their equities and fixed-income exposures.”

On the equities side, ETFs can access developed and emerging markets around the world, as well as a variety of industry sectors, such as energy, water, real estate or banks. ETFs also offer exposure to assets that are not correlated to traditional stock and bond indices, such as currencies, hard assets, gold bullion and put options. Some ETFs offer the potential for leveraged or inverse returns, or market-neutral and hedging strategies that can do well even in bear markets.

On a global basis, ETF AUM has exploded to US$2.9 trillion spread among more than 6,000 ETFs listed in 51 countries. The lion’s share of ETFs is listed in the U.S. – about US$2.1 trillion of global AUM – while Europe and Asia are the second- and third-biggest markets, respectively.

Canadians can access ETFs in other jurisdictions easily, in the same way as trading stocks on a foreign stock exchange.

However, there are significant tax advantages to achieving foreign diversification through the increasingly plentiful Canadian-listed ETFs that offer exposure to international stocks and bonds. Regardless of the domicile of underlying holdings, a Canadian-listed ETF owned by a Canadian resident is considered domestic property, and thus is exempt from U.S. or international estate taxes or reporting requirements on the part of the individual investor.

ETFs offer additional tax efficiencies through underlying portfolios that generally have less turnover than actively managed mutual funds – although the more active the ETF’s underlying investment strategy, the more likely that realized capital gains will be triggered, with the resulting taxes eating into portfolio returns. One solution on the tax front is corporate-class ETFs, an idea taken from mutual funds. These products are offered by Purpose Investments Inc. and First Asset Investment Management Inc., both of Toronto. However, as a result of a change proposed in the most recent federal budget, as of Sept. 30, 2015, investors will no longer be able to switch among ETFs within the same corporate-class structure without triggering tax consequences.

Still, there is an opportunity in a corporate-class family to share or transfer portfolio-management expenses, allowing the taxable gains or income earned by some ETFs to be offset by losses or expenses in others. The resulting tax efficiencies for corporate-class ETFs could allow for improved compound growth in the long term.

In Canada, there are 15 ETF manufacturers, including new entrants Mackenzie Financial Corp. and Toronto-Dominion Bank. Mackenzie has issued final prospectuses for four ETFs. The largest ETF in Canada as of Dec. 31, 2015, was iShares S&P/TSX 60 Index Fund, a broad-based index ETF, with AUM of $11.2 billion – almost 13% of the Canadian ETF market. However, the biggest seller in 2015 on the equities side was BMO MSCI EAFE Index ETF, while the bestselling fixed-income ETF was BMO Mid-Term US IG Corporate Bond Index ETF (both sponsored by BMO Global Asset Management Inc. of Toronto).

Active and smart beta ETFs are experiencing the fastest growth in the Canadian market. Among the 61 new funds launched in 2015, 13 were smart beta, 33 were actively managed and 15 were passive, according to Investor Economics.

More actively managed ETFs are expected as traditional mutual fund manufacturers bring their successful portfolio managers to market within the ETF structure. Historically, research has shown an inability of active portfolio managers to outperform the broad market over time, but the lower cost structure of ETFs relative to mutual funds removes one of the hurdles.

“What does the future hold? Ten years from now, I expect we will see more actively managed ETFs than index-based,” says Barry Gordon, president of First Asset, an ETF provider acquired last year by mutual fund giant CI Financial Corp. of Toronto.

The largest actively managed ETF at year-end was BMO Covered Call Canadian Banks ETF with $1 billion in AUM. Within the smart beta group, the leader was iShares Canadian Select Dividend Index ETF with $1.3 billion in AUM.

“Smart beta and active ETFs have garnered a lot of assets, and that indicates the end-user may not be entirely sold on market efficiency,” says Yves Rebetez, managing director and editor with Toronto-based research and consulting firm ETF Insight Inc. “ETFs are merely a distribution tool; that they must deliver only passive strategies is not written in stone. Everyone wants to develop the magical key to a better return. Not that many people will unlock the door, but they will keep trying.”

Although smart beta and active portfolio-management strategies attempt to offer a better way to invest, traditional index-based ETFs are competing aggressively on the basis of low fees – and those fees have sunk to rock bottom. Horizons Canada, for example, offers its S&P/TSX 60 Index ETF at a bargain-basement management expense ratio of three basis points.

© 2016 Investment Executive. All rights reserved.