SPECIAL SPONSORED CONTENT

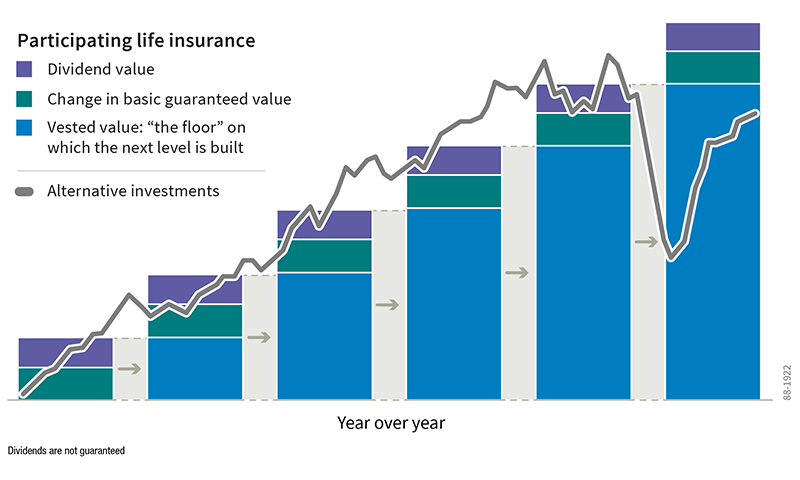

With more than 170 years of experience with participating life insurance (par), including exposure to financial crisis and extreme market movements, we’ve maintained our product offering and market presence. Now more than ever we believe in par and the value it offers. You and your clients can still depend on growing guaranteed cash values while we smooth investment returns to help reduce the effect of short-term volatility.

In addition to life-long insurance protection, par offers guarantees, and our long-term investment approach may be what clients are looking for right now. Consider how Canada Life™ par products offer the following advantages to clients during uncertain times like these:

- Guarantees – Even if interest rates remain at historically low levels, a policy’s guaranteed cash value continues to grow and the guaranteed death benefit is paid out if premiums are paid.

- Vesting – Once we distribute or credit a policyowner dividend to a participating policy, it is fully vested and can’t be reduced or used for any purpose other than as authorized by the policyowner, to pay premiums or to preserve the policy’s tax-exempt status. Policyowner dividends, once credited, can’t be negatively affected by future adverse experience.

We’re a market leader with a participating account standing strong at over $40 billion in assets 1. We believe in the value of participating life insurance as the foundation of a long-term financial plan.

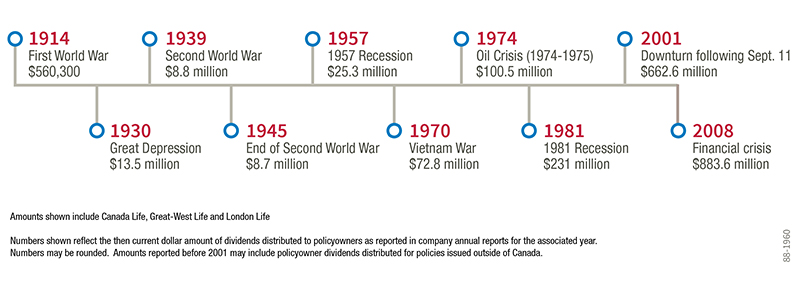

We have distributed participating policyowner dividends since 1848, even in difficult economic times. We’ve never left the participating life insurance market and our track record speaks foritself.

Click to enlarge image

Notes: Amounts shown include Canada Life, Great-West Life and London Life. Numbers reflect the then current dollar amount of dividends distributed to policyowners as reported in company annual reports for the associated year. Numbers may be rounded. Amounts reported before 2001 may include policyowner dividends distributed for policies issued outside of Canada.

Canada Life’s investment strategy, together with our approach of smoothing the returns for the purpose of determining the dividend scale, helps to reduce the volatility in the investment returns. For steady, long-term growth, we generally manage the participating account as a diversified fixed-income account. The target asset mix is about 75% fixed-income investments and 25% equities. Smoothing means we bring investment gains and losses in over time, which reduces volatility. It takes out the highs and lows and helps give more stability for any dividends paid out.

We balance risk and returns, with an asset allocation mix that delivers diversity and greater security for the long term. It’s about providing Canadians with results over the long-term and the confidence that comes with knowing we’ll be there when they need us.

Watch how easy it is to complete a participating life insurance policy on our digital application, SimpleProtect, right here.