Volatile markets, new regulations, new competitors and firms’ revised strategies and operations have changed the face of the securities industry. As a result, investment advisors surveyed for the 2016 Brokerage Report Card are looking for a little direction from their firms.

“The industry itself is a tough place to be. The global economy, combined with regulations, is brutal – however well intentioned the firm is,” says an advisor in Ontario with Toronto-based ScotiaMcLeod Inc.

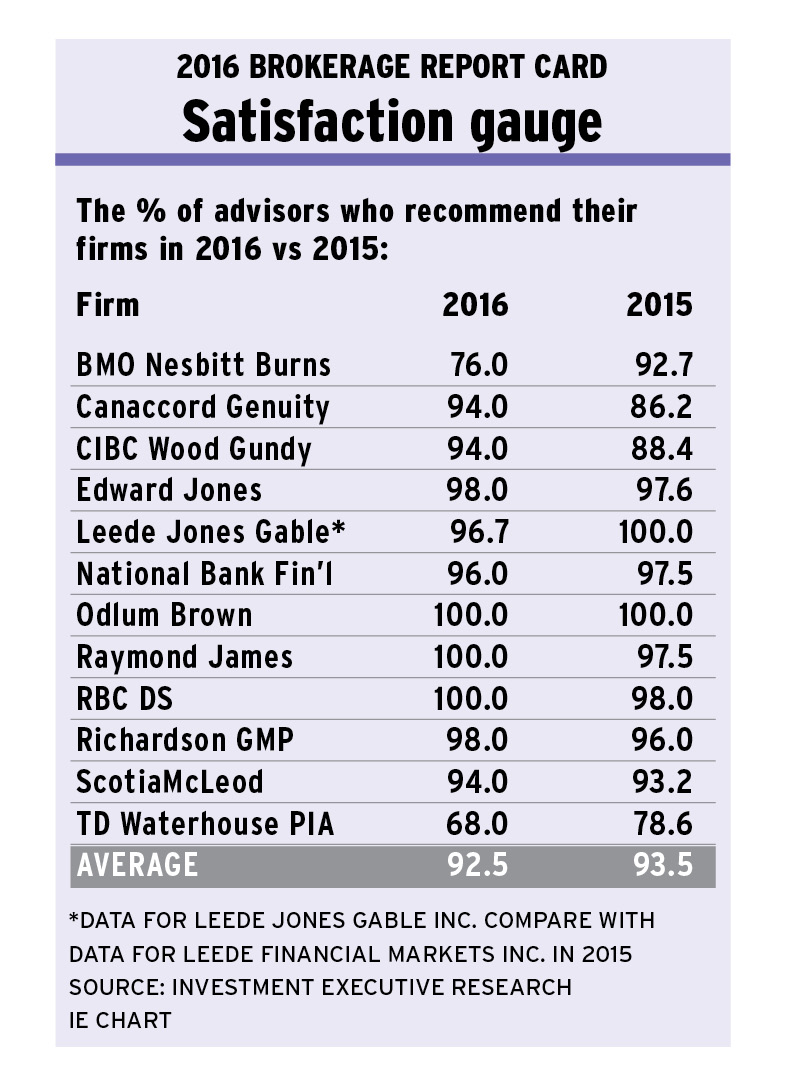

The uncertainty in the industry is evident in both this year’s main ratings (see Main chart) and the average advisor’s business (see Advisors are holding their own). For example, the rate of increase in assets under management within advisors’ books of business is virtually flat overall, at $113.3 million this year vs $113.7 million in 2015. Although this situation could be viewed as positive, given the volatility in equities markets in recent months, the past year marks the first time that advisors have failed to see growth in their books since the depths of the global financial crisis in 2008-09.

But while the size of the average book of business is stagnant, advisors’ compensation models – and their take-home pay – are not. To reflect the changes taking place in how advisors are compensated for the work they do, advisors were asked to rate their “firm’s support for advisors operating within a fee-based model” for the first time this year. (See Advisors relying on support.)

The implementation of the second phase of the client relationship model (CRM2) mandates enhanced cost disclosure for clients, so many advisors made or are considering the switch to fee-based compensation. These advisors appreciate firms that offer support in both technology and resources.

“[My firm] is really invested in the fee-based program. It is hiring four or five new people [and] will invest in the business,” says an advisor in Ontario with Toronto-based RBC Dominion Securities Inc.

Regarding the compensation advisors actually receive, the feedback was not so glowing. In fact, advisors said their firms keep making changes to their pay grids, resulting in advisors being paid less. (See Changes to pay miff advisors.)

“They changed the grid aggressively this year,” says an advisor in Ontario with Toronto-based TD Wealth Private Investment Advice.

Compensation was just one category in which that firm’s advisors expressed dissatisfaction. This year, the brokerage’s advisors rated their firm’s performance lower by half a point or more in 20 of the 31 categories for which the firm received a rating, as well as in the IE rating and the overall rating by advisors – the most significant rating drops for a firm in this year’s Report Card.

Calgary-based Leede Jones Gable Inc. (formerly Leede Financial Markets Inc.) is another firm rated significantly lower in several categories by its advisors this year. In fact, advisors with Leede, which merged with Toronto-based Jones Gable & Co. Ltd. late last year, rated their firm lower by half a point or more in 10 of the 28 categories for which the firm received a rating. But, despite those declines, Leede’s ratings, its IE rating and overall rating by advisors remain strong and advisors were satisfied with the direction taken by the firm.

“We’re still in the process [of merging],” says a Leede advisor in British Columbia. “Honestly, from the Leede side, it’s been seamless and painless. It’s nice to have increased our [geographical] exposure.”

Understanding and having faith in a company’s strategic focus, such as the reasons behind a merger, was a big theme in this year’s survey. In fact, a closer look at ratings in the “firm’s strategic focus” category indicates that even when a firm is given a low rating, overall morale is stronger when advisors know what management is thinking.

Case in point: Vancouver-based Canaccord Genuity Wealth Management (Canada) had one of the lower ratings, but in general, the firm’s advisors were upbeat about the firm’s global expansion plans.

“They keep advisors abreast of where they’d like to see the firm go,” says a Canaccord advisor in Alberta. “What they’re doing worldwide is encouraging.”

In fact, Canaccord’s advisors were happier this year, rating their firm higher by half a point or more in nine of the 31 categories in which it was rated – as well as in the overall rating by advisors.

However, not all advisors were as satisfied with their firms’ strategic focus. Advisors with bank-owned dealers were concerned about the focus on high-net worth clients vs smaller accounts. This was most evident among advisors with Toronto-based BMO Nesbitt Burns Inc., who feel the firm is directing them to move their smaller clients to SmartFolio, the parent bank’s recently launched robo-advisor platform.

“We’re having to get brutal on dismissing clients that don’t fit the model … and I get it,” says a Nesbitt advisor in Ontario. “But that means we’re severing what might be relationships that could bear fruit in the future. We’re in situations in which we’re advising clients who have been clients for 30 years to move to other areas of our enterprise.”

Robo-advisors represent yet another change in the securities industry faced by advisors. In light of the entrance of various robo-advisor startups into the marketplace over the past two years, advisors were asked if they considered these new platforms to be a threat to their business in a supplementary question added to this year’s Report Card. (See Robo-advisors not a cause for concern.) Despite the hype surrounding these online platforms, the responses reveal that most advisors are not concerned about robo-advisors.

“They’re just another form of a discount broker,” says an advisor in Atlantic Canada with Toronto-based CIBC Wood Gundy. “If I can respond with customized and credible advice, I’m fine.”

In another supplementary question, advisors were asked how well prepared their firms are for dealing with the unique issues relating to senior clients, given the greater emphasis on this demographic by regulators. (See Firms ready to deal with seniors’ issues). Advisors praised firms that take a clear path on how advisors can work with this expanding age group.

“They have been educating advisors about retirees,” says an advisor in Ontario with Toronto-based Raymond James Ltd. “We have to be extra-careful with their nest eggs [and] reduce risk in their portfolios.”

HOW WE DID IT

It’s not only the ratings shown in the main table in Investment Executive’s (IE) annual Brokerage Report Card that change from year to year. The categories in which investment advisors rate their firms – and the firms themselves – also undergo some changes every year.

IE research journalists Ahmad Hathout, Megan Marrelli, Beatrice Paez and Kat Shermack spoke with 560 financial advisors at 12 brokerages to obtain the results for this year’s Report Card. This includes one firm that appears under a new name: Calgary-based Leede Financial Markets Inc., which merged with Toronto-based Jones Gable and Co. Ltd. in October 2015, now goes by the moniker Leede Jones Gable Inc. IE research journalists spoke only with advisors who were previously with Leede Financial for this year’s survey. In 2017, former Jones Gable advisors will be surveyed as well.

There also were several changes to some of the categories in the main ratings table on page C4. For example, the “firm’s support for advisors operating within a fee-based model” category was added in response to the growing number of advisors moving toward a fee-based practice and away from a dependence on transaction fees. In contrast, the “firm’s support for constructing a deaccumulation strategy for retired clients” was removed as it was considered to be redundant among the other planning-related questions.

Finally, the “firm’s image with the public” category was reworded; instead, advisors were asked to rate their “firm’s reputation with clients and/or prospective clients.” This change clarifies that the category assesses a brokerage’s reputation within its community and client base rather than evaluates the firm’s advertising strategy.

All the ratings in the main chart are tabulated from two responses that advisors who participated in the survey gave for each question: one for their firm’s performance; another indicating the importance of that category to the advisor’s business. Advisors rated each category on a scale of zero to 10, with zero meaning “poor” or “unimportant” and 10 meaning “excellent” or “critically important.”

In addition, IE added two supplementary questions to the survey to get advisors’ views on industry trends. (See stories above).

© 2016 Investment Executive. All rights reserved.