Insurance advisors are generally happy with the marketing support their firms provide. Many advisors surveyed for this year’s Insurance Advisors’ Report Card praised their firms’ efforts to improve in this category.

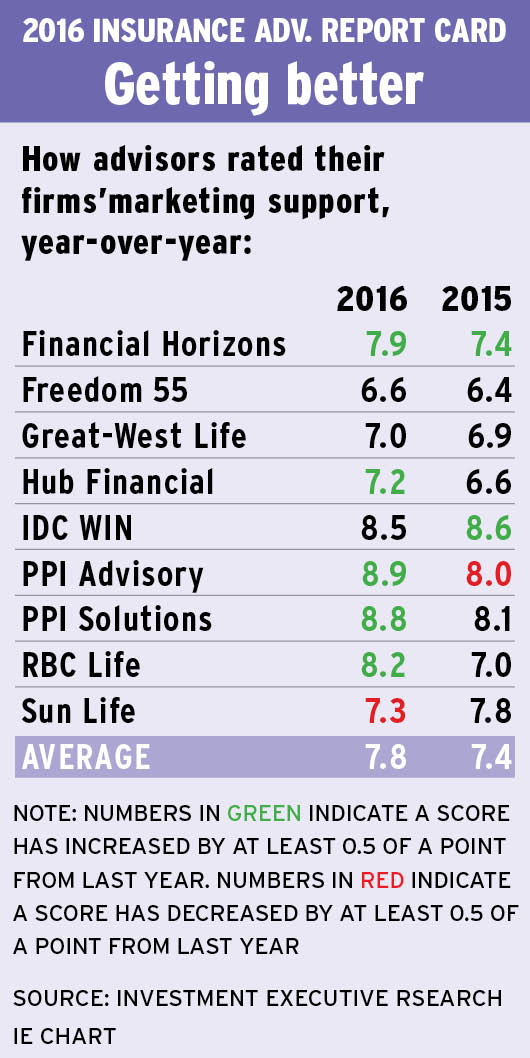

Specifically, the overall average performance rating in the “firm’s marketing support for advisor’s practice” category rose to 7.8 from 7.4 year-over-year. Five firms – Kitchener, Ont.-based Financial Horizons Inc., Woodbridge, Ont.-based Hub Financial Inc., Toronto-based PPI Advisory, Calgary-based PPI Solutions Inc. and Mississauga, Ont.-based RBC Life Insurance Co. – saw their ratings in the category increase by half a point or more. Only Waterloo, Ont.-based Sun Life Financial (Canada) Inc. saw its rating drop by that same margin.

The firms that received favourable ratings in the category were praised for their in-house marketing specialists, social media support and training, online resources and the customizable material provided to advisors to distribute to their clients.

Many advisors also expressed their preference for their ability to add their own personal spin to marketing materials, backed with support for compliance, some expenses and workshops.

Case in point: RBC Life advisors praised their firm for providing marketing specialists who can help advisors develop personalized materials. The firm saw its rating increase by the greatest margin in the category year-over-year, to 8.2 from 7.0 in 2015.

Even within the constraints of being associated with a bank, RBC Life advisors said that displaying their own personality in the marketing material is possible – especially on social media.

“Whenever you present your vision to [the firm], they’ll let you know if it’s compliant,” says an RBC Life advisor in Ontario. “They work with you to tweak it.”

RBC Life advisors can tap into pre-approved content through Hearsay Social, a compliant social media marketing management platform used in the financial services sector, to advertise their businesses on social media as well as connect with marketing specialists. One major frustration, though, is how willing RBC Life is to cover these costs.

However, access to a budget for social media advertising, for example, hinges largely on advisors hitting certain sales targets, says Mike Hamilton, RBC Life’s senior vice president of sales and distribution: “Once [advisors] reach a certain criteria, they have [a budget] available to them, and we do the investment on their behalf.”

Meanwhile, advisors with PPI Advisory gave their firm the highest rating in the category, at 8.9, up from 8.0 in 2015, but said they don’t lean on their firm as heavily as dedicated agents with other firms do. PPI Advisory advisors were pleased they have access to marketing materials for client communications, as well as in-house marketing specialists who can be relied on to help advisors prepare sophisticated presentations.

“We do a lot of joint presentations to professional groups – accounting groups, law firms. [PPI Advisory’s marketing team and the advisors] work a lot together. [The firm’s] technical advisors are available for me to utilize,” says a PPI Advisory advisor in British Columbia.

PPI Advisory’s approach is to “create very specific tools that help an agent specialize” in a particular area, says Jim Burton, the firm’s chairman and CEO, adding that advisors can find what’s relevant to their practices by using the online PPI Toolkit, which gets tweaked every year.

This year, he adds, “The focus was on designing a product for today’s life changes, so we developed a whole series of applications in our toolkit to help agents [discuss these changes with clients].”

Advisors with PPI Advisory’s sister firm, PPI Solutions, which saw its marketing support rating rise to 8.8 from 8.1 year-over-year, also have access to the same toolkit to help them market their practice.

“What we’re trying to do,” says Jim Virtue, president and CEO of PPI Solutions, “is help the advisor build his or her own brand.”

PPI Solutions advisors lauded the combination of the resources in the PPI Toolkit along with face-to-face consultations provided by internal marketing specialists.

“[PPI Solutions] puts us in touch with marketing specialists and people to help us with website development and rebranding,” says a PPI Solutions advisor in Ontario.

Hub is another firm that has online marketing resources available to advisors, says Terri Botosan, the firm’s president: “We have a lot of templates that we can provide to advisors [to help them] build their own brand on our website. We have templates of letters they can send to their clients and a host of self-service options.”

Hub advisors were impressed with the improvements they’ve seen in the firm’s marketing support resources, giving it a rating of 7.2, up from 6.6 in 2015.

“Over the past few years, they have been providing us with tools that are more user-friendly for us and our clients,” says a Hub advisor in Ontario. “[Hub is] actively improving [those tools].”

In contrast, Sun Life advisors rated their firm lower this year, at 7.3, down from 7.8 last year, because of the firm’s rigidity in preventing advisors from getting personalized marketing initiatives out in front of clients sooner.

“The compliance department is brutal,” says a Sun Life advisor in B.C. “I’ve been waiting five months to get a radio [ad] approved.”

Adds a colleague in Ontario: “The lack of flexibility is frustrating. You can’t change any messaging at all.”

© 2016 Investment Executive. All rights reserved.