Dedicated sales agencies and managing general agencies (MGAs) are getting much better at disseminating the information that insurance advisors need to keep their businesses compliant and running smoothly.

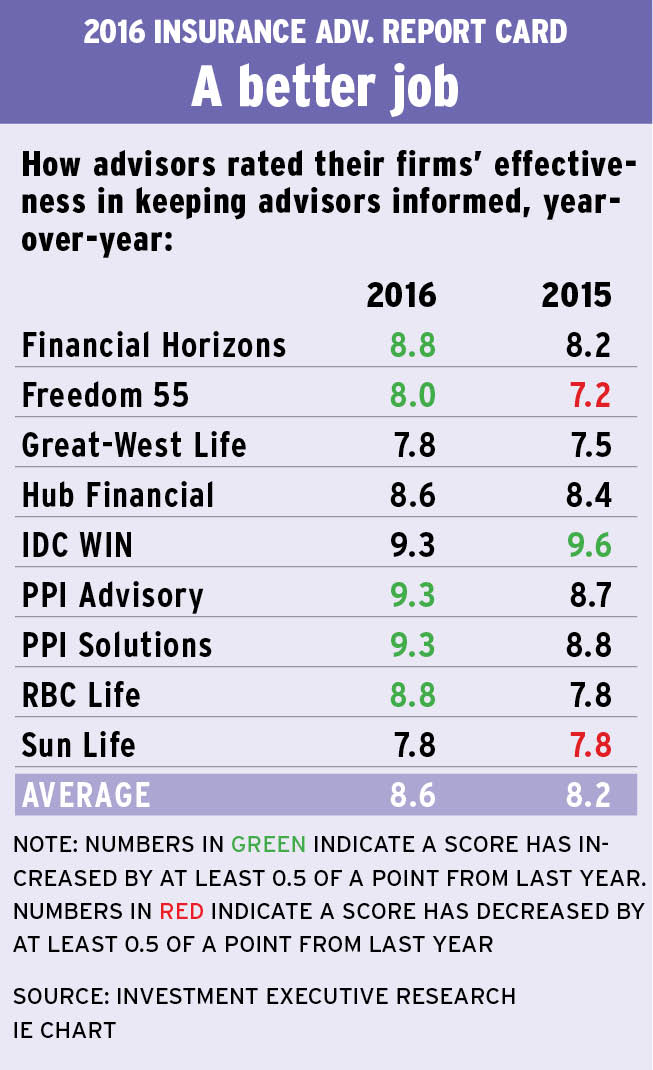

Case in point: five of the firms included in this year’s Insurance Advisors’ Report Card – London, Ont.-based Freedom 55 Financial, Mississauga, Ont.-based RBC Life Insurance Co., Kitchener Ont.-based Financial Horizons Inc., Toronto-based PPI Advisory and Calgary-based PPI Solutions Inc. – saw their performance ratings rise by half a point or more in the “firm’s effectiveness in keeping advisors informed” category. In turn, the overall average performance rating for the category rose to 8.6 from 8.2 year-over-year.

Not only do advisors consider their firms to be doing quite well at keeping their advisors informed, but this effort is something that matters greatly to advisors; they gave the category an overall average importance rating of 9.2 this year, up from an 8.9 in 2015.

This improvement could be the result of a broader cultural push toward constant communication – and it appears that for the most part, advisors’ needs are being met. Firms are making a concerted effort to let their advisors know about impending changes in both the insurance channel and the firm.

“Almost on a daily basis, we get correspondence. Whether it’s about compliance, changes in the industry, recent tax changes or budget information,” says an advisor in Ontario with Mississauga, Ont.-based IDC Worldsource Insurance Network Inc. “I’m 1000% satisfied.”

“I feel like anything that’s coming down the pipeline, we’re in the loop well in advance for anything that’s going to affect our business,” says an RBC Life advisor in the same province.

“They do everything,” says a PPI Solutions advisor in Atlantic Canada. “If I can read and move my mouse, I am informed.”

Although firms are doing a bang-up job at keeping advisors informed about what matters, this effort has created a new set of challenges. The most pervasive one that advisors cited is managing the ever-growing volume and speed of information.

“I can’t read all the stuff I get. I’m really well informed, but I have to spend time every week to go through all the stuff [the firm] sends,” says a Freedom 55 advisor in Ontario.

“There’s too much communication going out. You know the story of the boy who cried wolf? There’s so much communication that you start ignoring it,” says an advisor in Ontario with Waterloo, Ont.-based Sun Life Financial (Canada) Inc.

Executives also acknowledge that volume is an issue, and many firms are doing their best to try to solve the problem by sending advisors only the information they need. Yet, given the constant changes taking place in the industry, that’s a challenge that even firms struggle to keep up with.

“It’s the wealth of information – we get fed a lot of information,” says Patricia Ziegler, chief operating officer with Financial Horizons. “There’s information coming at us all the time. Our biggest challenge is trying to filter the information we’re receiving and to try to give advisors the information or content that’s important to them in a timely fashion. It’s also important to keep them away from stuff that isn’t important to them.”

“The volume of change means that new things are coming out on a regular basis,” says Vicken Kazazian, senior vice president and chief operating officer, individual insurance and wealth, with Sun Life. “Our advisors’ ability to keep up with the change is a big challenge.”

As a result, some firms are doing what they can to help advisors stay on top of what’s important. Specifically, firms are looking to cross-platform and multimedia communication to mitigate the speed and influx of new information coming advisors’ way.

“We’re exploring other ways we can do this,” says Kazazian. “We’re repeating information in different forms using multimedia. More use of social media [is] a mechanism we are experimenting with.”

Using multimedia, especially videos, is one method that some firms are opting for to encourage advisors to keep on top of the latest news affecting their businesses.

“We recently started sending out YouTube videos with updates to advisors,” says Ron Madzia, president of IDC WIN. “We find it’s easier for advisors to watch a short video than it is to read a long email or newsletter.”

Financial Horizons also is “creating a lot more video, as opposed to written content,” Ziegler points out. “If somebody only has a minute to read something, could he or she watch or listen to it instead? A lot of our advisors spend a lot of time in airports or in cars, so we’re trying to meet their needs in a more effective fashion.

“I won’t say everything we do is in video form,” she adds, “but we are really trying to drive toward video presentations or webinar training because people just don’t have time to read anymore.”

© 2016 Investment Executive. All rights reserved.