When the banks first began dipping their toes directly into the retail investment business, those institutions were scoffed at and thought likely to fail. Yet, they have long since proven the doubters wrong, and new data on the banks’ in-house advisory forces reveal just how successful the deposit-taking institutions have become in the investment business.

The latest edition of Investment Executive‘s (IE) Report Card on Banks represents a departure in approach and methodology from previous surveys in this series in that IE now focuses exclusively on the Big Six banks and their branch-based advisors.

Furthermore, within the banks themselves, IE is conducting surveys solely with investment- focused advisors and excluding bankers that are involved only minimally with investing and focus largely on lending instead.

Given these changes in IE‘s approach, comparisons of the average advisor in this channel from years past is a difficult exercise. But by zeroing in on the bankers that are genuine rivals of advisors at brokerage firms and mutual fund dealers, IE’s research provides a clearer picture of the banks and their competitive position within the retail investment industry – and that picture reveals that the banks probably are much stronger than previously thought.

According to the results of this year’s survey, the average advisor in the banking channel now has slightly less than $100 million in assets under management (AUM). Although this still leaves these advisors some distance behind the average broker – who reported $113 million in AUM on average in this year’s survey – the bankers clearly are well ahead of the mutual fund dealer reps, who reported $39 million in AUM on average.

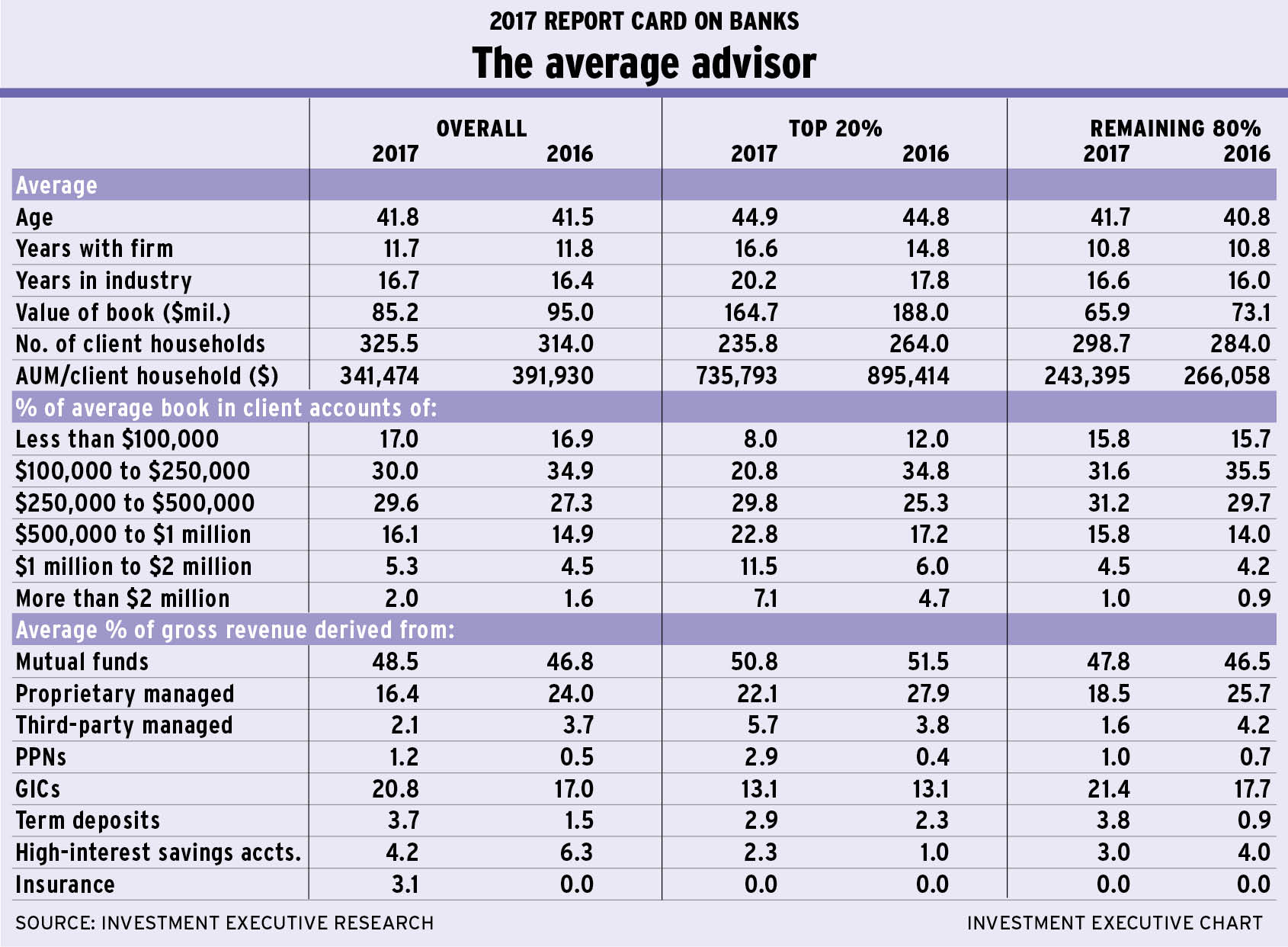

Advisors with banks also are notably younger, just 41.5 years old on average vs 49.6 years old in the brokerage channel on average and 53.2 years old in the mutual fund dealer channel on average. Given bankers’ relative youth, they have a bit less experience than their counterparts at brokerage and dealer firms. Even so, bankers have been in the business for 16.4 years and with their current firms for 11.8 years.

These age and experience data are in line with those in previous years’ surveys of the banking channel; however, in light of advisors reporting much higher AUM totals this year, it’s apparent that the banks and their branch-based advisors are very successful in the retail investment business. Indeed, looking at asset gathering over time in the business, bankers appear to be building their books at a slightly faster rate per year of experience than brokers are.

However, brokers still hold a significant advantage in productivity. The average banker has a significantly larger client roster than the average broker. Although brokers serve 173.4 client households on average, the average banker has 314 client households on the books. So, while the bankers appear to be rivalling brokers in average AUM, bankers’ AUM is spread across a much larger client base.

In productivity, the average banker has $391,930 in AUM per client household. In addition, the account distribution of the average banker’s book is more heavily skewed toward lower-value accounts compared with brokers. In fact, 51.8% of the average banker’s book is devoted to accounts worth less than $250,000 and 79.1% of the average book is in accounts that are smaller than $500,000.

The average banker has relatively few accounts that come in above the $1 million mark (about 6.1% of their book on average), but bankers are more than holding their own in the “mass affluent” part of the population. The largest account category for bankers is the $100,000-$250,000 range, which represents 34.9% of the average book. The $250,000-$500,000 category ranks second, making up 27.3% of the average book.

Segmenting the bankers by productivity (AUM/client household), the data show that there isn’t much in the way of demographics that distinguishes the top 20% of advisors from the remaining 80%, other than the fact that the top performers are a bit older and have been in the business for slightly longer, which has given them more time to build substantially bigger books.

For example, the average top advisor is 44.8 years of age, with 17.8 years in the business, vs an average of 40.8 years of age and 16 years of experience for the remaining 80% of advisors. The top performers have also been with their current firm for longer, at 14.8 years vs 10.8 years for the remaining 80%.

Along with age and experience, top performers also boast significantly greater AUM than the remaining 80% of advisors despite serving client bases that are roughly the same size. Top performers reported having an average of $188 million in AUM vs with $73.1 million for the remaining 80% of bankers. Given the similarly sized client bases in both advisor segments (264 client households for top performers vs 284 for the remaining 80%) with the vastly different AUM totals, the top 20% of advisors also enjoy much greater productivity: average AUM/client household for the top advisors is $895,414 vs $266,058 for the remaining 80% of advisors.

Not surprising, the distribution of top performers’ client accounts also skews toward the higher end of the spectrum, as 10.7% of AUM falls into the $1 million or more category; in addition, the top advisors also reported somewhat lower allocations to accounts worth less than $500,000. That said, aside from productivity, the differences between the two advisor segments are not dramatic.

With both segments of the banker population gathering AUM and building relatively upscale client bases, one of the chief beneficiaries of this activity is the banks’ asset-management divisions. In terms of asset allocation, 24% of client assets on bankers’ books are invested in proprietary managed products – a striking difference to the rest of the investment industry. (Only 2.7% of the average broker’s book and 1.1% of the average dealer rep’s book is in proprietary managed products.)

Moreover, although IE’s research doesn’t distinguish between proprietary and third-party mutual funds, the data indicate that 46.8% of the average banker’s book is devoted to mutual funds. Assuming a healthy chunk of this AUM is going into the banks’ brands of mutual funds, these advisors are exceptionally powerful distribution forces for their in-house money managers.

In addition, most of the rest of the average banker’s book is invested in some form of banking product, with 17% in guaranteed income certificates, 6.3% in high-interest savings accounts, 1.5% in term deposits and 0.5% in principal-protected notes. In total, 25.3% of the average banker’s book is in banking products; and while some of that may involve outside products, the bulk of this probably is proprietary, too. Indeed, only 3.7% of the average banker’s book is explicitly in outside products (third-party managed products).

The survey also found that banks are generating these asset flows with very different compensation structures. Whereas other reps rely on a mix of fees and commissions, 54% of bankers’ revenue comes from straight salary. The rest is derived from a mix of sources, such as bonuses (14.1%), transactions (18.4%) and fee- or asset-based sources (13%).

© 2016 Investment Executive. All rights reserved.