Canada’s major brokerage firms appear to be paying greater attention to financial planning, with some firms increasing the support they offer financial advi-sors. As a result, the percentage of advisors who do financial plans for their clients has improved significantly in this year’s Brokerage Report Card.

At first glance, things look pretty stagnant in the “support for developing a financial plan for clients” category, as the overall average rating rose only slightly, to 8.1 from 8.0 in 2012. But, upon closer inspection, four firms — Mississauga, Ont.-based Edward Jones, Calgary-based Leede Financial Markets Inc. and Toronto-based bank-owned brokerages CIBC Wood Gundy and ScotiaMcLeod Inc. — saw their ratings in the category increase by half a point or more.

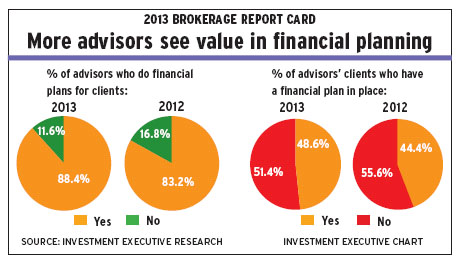

In addition, more advisors say they are preparing financial plans for their clients. The percentage of advisors surveyed who say they do so rose to 88.4% from 83.2% year-over-year, while the percentage of their clients who have a financial plan in place also rose, to 48.6% from 44.4% last year.

“Financial planning is now becoming a requirement, and the firm is encouraging us to do a plan if the client comes from a branch,” says an advisor in Ontario with Toronto-based TD Wealth Private Investment Advice (TD Wealth PIA).

Better services, software

In fact, the increase in the percentage of advisors who say they do a financial plan, as well as in the clients who have one in place, could be the result of several firms beefing up their financial planning departments, as well as the software programs those firms offer advisors so they can do this task.

“We recently launched new software for financial planning, which has greatly improved our overall package,” says an advisor in Ontario with Toronto-based Macquarie Private Wealth Inc.

Adds an advisor in Atlantic Canada with Montreal-based National Bank Financial Ltd.: “The firm provides a group of financial planners with high-end planning for complicated situations. They are always accessible when you need them.”

A key reason why Scotia-McLeod saw its rating increase by a full point in the category — to 7.7 from 6.7 — is that the firm increased the support it offers its advisors in this area. In October 2012, the firm hired Rob McGavin as managing director, financial planning and advisory services, Canadian wealth management. McGavin travels across the country, meeting with advisors directly to assist with in-branch resources and financial planning tools.

“This has been a key focus for us,” says Hamish Angus, managing director and head of ScotiaMcLeod. “I think more advisors are acknowledging and recognizing the value in financial planning. We have a good network of financial planners in the field right now; and, as time goes on, we will increase that.”

These efforts have certainly paid off. The firm saw a significant increase in the percentage of its advisors’ clients who have a financial plan in place, now 54.2% vs 41.4% last year.

TD Wealth PIA also appears to be ramping up its support services for financial planning. As a result, almost 98% of the firm’s advisors surveyed report creating financial plans for their clients, with 60.6% of their clients now having a financial plan in place — the highest percentage reported in the Report Card.

“In the past, we had to call national head office for support,” says a TD Wealth PIA advisor in Ontario. “Now, we have someone in-house, so it should improve.”

This bank-owned brokerage’s success may have something to do with the recent implementation of new financial planning software, dubbed the Investment and Wealth Planning System (IWPS). TD Wealth PIA launched the program in 2010 and, over the past few years, has conducted extensive training sessions for its advisors on the platform, as well as launching additional wealth planning tools on the firm’s intranet.

“Financial planning has become a key part of the discussions we are having with clients,” says Mike Reilly, TD Wealth PIA’s president and national sales manager. “And the availability for advisors to do financial plans is fully implemented here.”

The firm’s advisors couldn’t be happier with the system. Says a TD Wealth PIA advisor in Ontario: “The IWPS solution has made huge leaps by being redesigned to be more simple and user-friendly.”

Some firms may not be able to pinpoint why their ratings in the category are increasing. Case in point: Vancouver-based Odlum Brown Ltd. hasn’t done anything specific over the past year to encourage its advisors to do more financial plans; still, the brokerage saw the biggest surge in advisors who do financial plans for clients: 90.9% of advisors surveyed this year do so, compared with 74.1% in 2012.

“We have phenomenal team support that will sit in on client meetings,” says an Odlum Brown advisor in British Columbia. “And the turn[around] is quick.”

Odlum Brown, a small regional firm of 85 advisors, continues to offer free financial planning services to both its advisors and clients through the company’s financial planning arm, Odlum Brown Financial Services Ltd.

“Financial planning is a cornerstone of how we run our business,” says Debra Hewson, president and CEO of parent firm Odlum Brown. “We are continuing to do what we have always done, which is encourage every advisor to do a financial plan for every client if they chose to do so.”

A different approach

But not every firm is pushing its advisors to create clients’ financial plans by themselves. For instance, Wood Gundy offers its advisors access to financial planning software and additional training, if required; but Monique Gravel, the firm’s managing director and head, says she prefers to offer advisors access to financial planning experts who can put those plans together — an approach that seems to be paying off, as the firm saw its rating in the category improve to 8.5 from 7.7 last year.

“If advisors are spending their time preparing financial plans, they are not spending their time taking care of their clients,” Gravel says. “My preference is to have my financial [advisors] taking care of their clients and have someone else prepare a plan and help the [advisor] deliver the fully prepared financial plan.”

© 2013 Investment Executive. All rights reserved.