Each quarter I post a template for a client letter, as a starting point for advisors who want to send clients an overview of the three months that just ended and an outlook for the period ahead. Advisors tell me they get a great response to these letters.

Use as much of the content below as is appropriate for you, keeping your letter as short as possible. Be sure to customize the letter to reflect your views, especially when it comes to recommendations for the period ahead.

Here are the components of this quarter’s letter:

- An update on performance

- Context and perspective on recent macroeconomic events

- Lessons from history

- Recommendations for the period ahead

“When feeling seasick due to rough waters, keep your eyes on the horizon”

‑ Advice for passengers on ocean liners

As we enter the last quarter of 2014, I’m writing to summarize market performance since the start of the year and to share my thoughts on positioning portfolios given market turbulence arising from recent geopolitical events. I’ll also share three principles that have led to solid performance in the past, which are at the core of my approach.

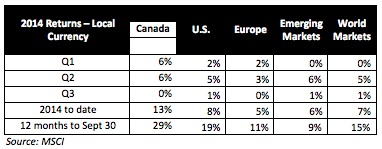

Despite turbulence in the last half of September, U.S. and global stock markets built on the very positive returns of 2012 and 2013. Note that very strong performance in the last quarter of 2013 boosted twelve month returns.

This strong performance came in the face of headlines dominated by big-picture economic and political uncertainty:

- The Ebola epidemic threatening parts of West Africa

- The resurgent movement of religious militants in Iraq and Syria

- The bellicose Russian leadership and political tensions in the Ukraine

- The concern about slowing growth in China, with particular focus in the last couple of weeks on political unrest in Hong Kong

- The continued struggles in much of Europe to achieve sustained growth, with unemployment continuing to pose challenges

Given this uncertainty, a couple of clients have recently asked if they should sell stocks. In light of that, I want to recap three principles that guide my approach to constructing portfolios.

Principle One: No one can predict short term market movements

Since the advent of financial news networks, a cottage industry has sprung up of pundits forecasting the direction of markets in the next three, six and twelve months.

Anyone who claims they can predict short term market movements is either kidding themselves or kidding you. The evidence on this is clear-cut – a comprehensive study by Vanguard on forecasting stock returns. This study examined 15 popular measures used to forecast returns – and found that none of them had meaningful predictive power for the next 12 months. Indeed, the most accurate of these only explained less than half of returns over the following 10 years.

In the interest of getting at least one call right, many market forecasters seem to use the philosophy of “Predict Early and Predict Often.” If you’re still unsure, you may be interested in this article on “The Four Worst Market Calls Ever.”

Principle Two: We’ve overcome uncertainty before

Warren Buffett has written at length about the resilience of American business in prospering through economic downturns, wars and other serious headwinds. Indeed, if we go back to the end of 1990, here’s what the United States and the global economy faced:

In August of that year, Iraq invaded Kuwait. It was not until January of 1991 that a coalition of Western and Arab nations led by the United States responded. In the meantime, uncertainty about what would happen meant that oil prices doubled.

Starting early that year, Western economies went into a significant recession, which hit its peak in the fourth quarter. In the four months from July to October, the stock market was off 15%. For the year as a whole the market lost 7%.

In the aftermath of $500 billion in write-offs in the savings and loan sector, there was a widespread view that the U.S. was on the threshold of a full-fledged banking crisis. Loan defaults spiked and bank profits dropped. Nine hundred U.S. banks had failed in the past five years and another 1,000 were on the problem list. In response, banks cut back on loans, even to credit-worthy borrowers. From July to December, bank stocks such as Citibank and Chase Manhattan dropped by half. An editorial in BusinessWeek had a typical view: “The banking sector is under economic strain. Should it begin to unravel, recession could become an economic disaster.” If this had happened, the U.S. would have pulled Canada and the rest of the world down with it.

Of course, we now know that the period that followed saw strong economic growth, and investors who maintained their stock holdings saw buoyant returns. We have worked through many significant problems before – and the recent positive signs in U.S. employment numbers and economic growth give me confidence that we’ll do the same this time. As to geopolitical concerns that dominate headlines, I don’t dispute that they’re serious. But remember that everything you read is already reflected in the stock market – so the things that we know about these issues are already taken into account.

Principle Three: Valuations Matter

Having said that it is impossible to time markets with accuracy, the Vanguard study of 15 market indicators showed two measures that have the highest correlation with returns in the following 10 years.

In second place came price-earnings, using trailing earnings for the previous year.. The best predictor of future returns was also price earnings, using earnings for the previous 10 years adjusted for inflation, an approach popularized by Yale’s Robert Shiller, recipient of last year’s Nobel Prize for economics.

The Canadian stock market’s strong performance over the past 12 months means that price earnings valuations are expensive compared to historical levels. For the U.S. market, price-earnings multiples using earnings for the previous year are slightly elevated compared to their historical average. Using 10 years of earnings, as Robert Shiller suggests, the outcome is more concerning: At the end of September, the U.S. stock market was priced at 26 times average earnings for the past 10 years, more than 50% above the long term average of 16 times 10-year earnings. While this valuation does not approach the 44 times seen at the height of the tech bubble, it does suggest that in the next 10 years, returns on U.S. stocks will likely be lower than their historical average.

One response is to look outside the United States for stock markets that are more reasonably priced. In late August, Princeton’s Burton Malkiel wrote a Wall Street Journal article titled “Are Stock Prices Headed for a Fall?” In that article, he suggests that investors consider adding emerging-markets stocks to their portfolios. Those stocks’ valuations based on 10-year earnings are 40% below that of the U.S. market. Another response is to look selectively at stocks in Europe and Japan that trade at lower levels than comparable U.S. companies.

What this means for your portfolio

In past emails, I have outlined some guiding principles in my approach to building client portfolios, two of which I repeat here: rebalancing your portfolio and diversifying your investments. I’d be pleased to discuss these guidelines at our next meeting.

Rebalancing your portfolio:

At points in the past, we recommended that clients increase their equity allocations. Given strong stock performance since the start of 2011, that has worked out well and we continue to advise that clients hold above-average equity weight.

But strong performance by stocks means that today some clients are above the top of their equity allocations. In those cases, we have been recommending reducing equity weighting to bring portfolios back within their guidelines. Regardless of what happens to markets in the short term, barring a significant change in your circumstances, you should stick to your investment parameters.

Diversifying investments:

When building equity portfolios, I’ve always advocated strong diversification outside Canada.. This helped my clients through most of the 1990s and since 2008 and hurt them in other periods such as 2000 to 2007.

Going forward, the Canadian dollar and stock market may do better or worse than global markets. However, given that we represent less than five percent of the investing opportunities around the world, to maximize returns we must be willing to look abroad. That’s especially the case when we look at relative valuations in Canada compared to abroad.

I recognize that today seems like a particularly uncertain time, and I hope you find this overview helpful. Ultimately, every client’s needs are unique, and we work hard to develop the portfolio that is right for your personal risk tolerance and situation. Should you have questions about this note or any other issue, please feel free to give me or one of the members of my team a call.

As always, thank you for the opportunity to serve as your financial advisor. And when you read another headline about uncertainty in the world today, remember that advice when encountering rough seas and try to stay focused on the horizon, as my team and I do each and every day.

Dan Richards conducts programs to help advisors gain and retain clients and is an award winning faculty member in the MBA program at the University of Toronto. To see more of his written commentaries, go to www.danrichards.com or here for his videos.