Investors have long turned to real estate for income, inflation protection and diversification. There are a variety of ways to access this asset class, including private, direct investments in bricks-and-mortar properties, debt investments backed by real estate, publicly traded Real Estate Investment Trusts (REITs) and publicly traded debt-like instruments. Each of the four main types of real estate exposure – private equity, private debt, public equity and public debt – has its own set of advantages. Arguably the best approach is to combine their complementary benefits.

Combining strengths

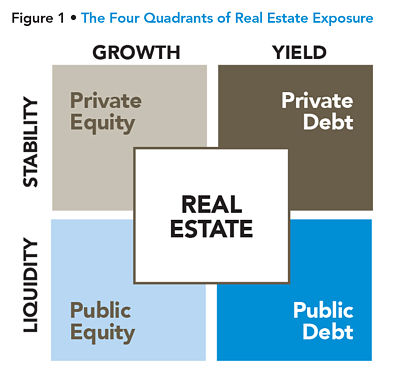

Having all four types of real estate exposure “allows investors to offset the limitations of one type with the benefits of another,” explains Corrado Russo, Senior Managing Director, Investments and Global Head of Securities, Timbercreek Asset Management, a global asset manager specializing in real estate. Figure 1 illustrates the primary features of each type of exposure.

Private equity: high returns with low volatility

A private equity allocation consists of direct investments in real estate (bricks-and-mortar investments) and privately held companies that primarily own real estate. Russo suggests the focus should be on investments where value can be created by improving net operating income (e.g., through renovations or recapitalization) or the overall quality and competitiveness of the property.

Private debt: stable income

A private debt exposure involves direct investments in debt that’s secured by real estate or issued to companies that focus on real estate. The aim of the portfolio manager should be to identify opportunities that generate more yield than would normally be expected for the level of risk undertaken. “Timbercreek’s focus,” notes Russo, “is on shorter-duration mortgage loans to protect invested capital in a rising interest rate environment.”

Public equity: strong returns with high liquidity

This is the most liquid form of real estate investing, targeting common equities of publicly traded issuers backed by real estate, such as real estate investment trusts (REITs). Investing in REITs provides a diversified exposure to real estate assets. Russo targets both income and opportunistic growth with the aim of generating substantial returns.

Public debt: stable income and liquidity

A public debt exposure includes investments in publicly traded preferred stock, unsecured debt, convertible debentures, preferred equity of REITs and mortgage REITs. Timbercreek targets undervalued securities to generate outsized returns. “As with private debt, I’m looking for securities with yields that are greater than would be expected given their risk levels,” says Russo.

Where one of these four types of exposure shows limitations, another steps in to offset it. For example, private equity’s stability comes at the expense of liquidity. This disadvantage is overcome when the investor has an allocation to public real estate equity and debt. Conversely, while strong active management will dramatically reduce the volatility of a public real estate portfolio, an allocation to private equity and debt can provide a degree of stability that exchange-listed investments cannot match.

By the numbers

A portfolio that includes a real estate allocation combining all four exposure types has substantial benefits over the typical 60% equity, 40% bond portfolio. In addition, Figure 2 illustrates the benefits of achieving the optimal combination of global direct and global listed property (based on 25 years of performance, ending December 2015).

A 30% allocation to global listed property and a 70% allocation to global direct property provides the highest potential return with the lowest volatility of returns in a global property portfolio.

Best of all worlds

Innovative new solutions now enable clients to harness the full range of benefits real estate offers. With a multi-strategy approach, investors no longer have to make compromises to achieve liquidity, stability, income and growth.

Timbercreek Asset Management is a global expert in private and publicly traded real estate investments, focused on delivering predictable, sustainable and growing returns to investors.

For more information on Timbercreek’s investment solutions, including the Timbercreek Four Quadrant Global Real Estate Partners visit Timbercreek.com/advisors

Partner Reports is a space made available for businesses who wish to publish content for financial professionals. Investment Executive journalists are not involved in writing these articles.